(Finance) – Uncertainty and volatility reign on Wall Street, especially after the Federal Reserve admitted the risk that inflation in the US could consolidate. From the minutes of the last meeting of the American central bank, held on 14 and 15 June last, it emerged the intention and confirmation by the board of the Fed to maintain the rate hike because the price estimates have worsened and therefore a retouch upwards of the cost of borrowing in July from 0.50 to 0.75 points is “appropriate”.

According to US central bankers, “the economic outlook justifies moving towards a restrictive policy line”. And “they recognize the possibility that if high inflationary pressures persist, an even more restrictive line might be appropriate.”

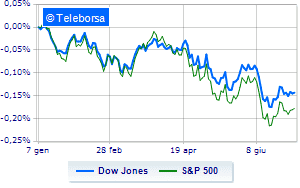

Among the US indices, the Dow Jones 0.30% file, while, on the contrary, theS & P-500, with the prices reaching 3,825 points. Without direction the Nasdaq 100 (+ 0.11%); on the same trend, almost unchanged theS&P 100 (-0.15%).

Significant upside in the S&P 500 for the fund utilities. Among the most negative on the list of the S&P 500 basket, we find the sectors power (-2.35%), secondary consumer goods (-0.89%) e financial (-0.84%).

To the top between giants of Wall Street, Cisco Systems (+ 1.20%), United Health (+ 1.08%), Travelers Company (+ 0.95%) e Merck (+ 0.69%).

The strongest sales, on the other hand, show up on Chevronwhich continues trading at -1.84%.

In red Walgreens Boots Alliancewhich shows a marked decline of 1.64%.

The negative performance of Walt Disneywhich falls by 1.62%.

Caterpillar drops by 1.59%.

On the podium of the Nasdaq titles, Lucid (+ 5.75%), Constellation Energy (+ 2.38%), Idexx Laboratories (+ 2.05%) e Modern (+ 1.78%).

The strongest falls, on the other hand, occur on Pinduoduo Inc Spon Each Repwhich continues the session with -9.01%.

Letter on JD.comwhich recorded a significant decrease of 5.31%.

Goes down Baiduwith a fall of 5.04%.

Collapses NetEasewith a decrease of 4.17%.

Between the data relevant macroeconomics on US markets:

Wednesday 06/07/2022

15:45 USA: Composite PMI (expected 51.2 points; preceding 53.6 points)

15:45 USA: PMI services (expected 51.6 points; preceding 53.4 points)

4:00 pm USA: Non-manufacturing ISM (expected 54.3 points; previous 55.9 points)

Thursday 07/07/2022

13:30 USA: Challenger layoffs (formerly 20.71K units)

14:15 USA: ADP busy (expected 200K units; previous 128K units).