(Finance) – Elevated seat for the FTSE MIBwhich stands out among the main European stock exchanges, thanks toexcellent performance of the banks. There are speculations about banking risk (Il Foglio reported that a large investment bank is preparing a feasibility study relating to an operation that would see the acquisition of Mediobanca from UniCredit via a public exchange offer in a 12 billion euro operation, which would eventually also involve General), i analysts’ opinions (BofA has improved the recommendation on BPM desk to Buy from Hold, with a target price of 7 euros from the previous 5.5 euros, inserting the stock into its Europe list 1) and the next basket review (Banca Popolare di Sondrio could enter the FTSE MIB instead of Generali Bank).

On the macroeconomic frontin Germany the final reading of GDP for the 4th quarter of 2023 confirmed the preliminary results: -0.3% q/t -0.2% y/y. The contraction was caused by a sharp decline in investments (-1.9% q/q) which more than offset the growth in consumption (+0.2% q/q) and public spending (+0.3% q/q /t).

As for the monetary policy, Robert Holzmann – governor of the Austrian central bank – believes it is unlikely that the ECB will cut interest rates before the Fed, while Joachim Nagel – president of the Bundesbank – said that “although it may be very tempting, it is too early to cut interest rates”.

L’Euro / US Dollar it is essentially stable and stops at 1.084. L’Gold it is essentially stable at 2,025.1 dollars an ounce. The Petrolium (Light Sweet Crude Oil) lost 1.62% and continues to trade at 77.34 dollars per barrel.

Unchanged spreadwhich is positioned at +147 basis points, with the yield of the ten-year BTP which stands at 3.88%.

Among the European price lists stop Frankfurtwhich marks almost nothing accomplished, neglected Londonwhich remains glued to the levels of the day before, and is moving modestly upwards Parishighlighting an increase of 0.62%.

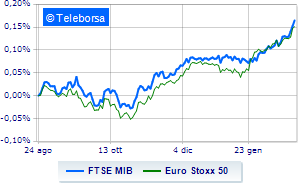

Positive session for the Milanese price listwhich shows a gain of 0.77% on FTSE MIB, consolidating the series of four consecutive increases that began last Tuesday; along the same lines, positive performance for the FTSE Italia All-Share, which continues the day up 0.71% compared to the previous close. Moderately rising FTSE Italia Mid Cap (+0.2%); on the levels of the day before FTSE Italia Star (-0.18%).

At the top of the ranking of the most important titles of Milan, we find Mediobanca (+5.28%), Generali Bank (+4.04%), Generali Insurance (+3.78%) e BPM desk (+3.59%).

The worst performances, however, are recorded on ERG, which gets -1.04%. Lame Fineco, which shows a small decrease of 0.98%. Modest descent for Snam, which drops a small -0.89%. Thoughtful Inwitwith a fractional decline of 0.74%.

Among the protagonists of the FTSE MidCap, Philogen (+3.72%), Ferretti (+1.99%), Banca Popolare di Sondrio (+1.95%) e Anima Holding (+1.72%).

The steepest declines, however, occur at Maire Tecnimont, which continues the session with -2.14%. In red Ariston Holding, which highlights a sharp decline of 1.56%. He hesitates LU-VE Group, with a modest decline of 1.40%. Slow day for GVSwhich marks a decline of 1.32%.