Another day in the red for the Casino action, which lost up to 21.5% on Friday morning July 28 before – relatively – recovering. The day after the announcement of colossal losses for the first half, the distributor indicated that an agreement in principle had been reached with a consortium of investors, including Czech billionaire Daniel Kretinsky. On the program, a restructuring of the debt and a capital increase with strong dilution of the shareholders at the key. An announcement welcomed by the Minister of the Economy, Bruno Le Maire, judging that it opens “the way to a lasting solution for the future” with “an ambitious and robust industrial project”. For Pascal Quiry, professor at HEC and co-author of the bible for finance students, the “Vernimmen” is a lesser evil.

L’Express: How do you judge the agreement concluded between Daniel Kretinsky, Fimalac and the Attestor fund on the one hand, and the Casino group on the other, when it will cause a very strong dilution of shareholders, including Jean -Charles Naouri, but also small carriers?

Pascal Quiry: This is a classic operation for a group that is almost bankrupt. This may be shocking because such a situation is rare for listed companies but it is consistent with financial logic. To escape bankruptcy, new money must be handed over and the debt converted into equity, because the company is no longer able to pay its financial expenses and its debt maturities. We are exactly in the case of Orpea: the value of the assets is no longer sufficient to meet the debts. Creditors then prefer to transform them into equity rather than lose everything and recover shares.

These operations presuppose the issue of a large number of shares: the shareholders who do not follow, that is to say who do not reinvest by participating in the capital increase to the extent of their rights, will be massively diluted. Maintaining their percentage of ownership in the company would require large sums that not everyone will want or be able to agree to. Daniel Kretinsky and his partners try to save the company. If Casino filed for bankruptcy, the shareholders would lose everything, so it’s the lesser evil, even if the pill is bitter.

The outcome seemed inevitable. Shouldn’t she have intervened sooner?

The difficulties gradually accumulated. Casino’s economic profitability has been lower than its cost of capital since 2011. Turnover has been falling since 2013, the company has been burning cash since 2017… But it is a business with a negative working capital requirement because the customer pays cash when the distributor pays its suppliers at 45 days. This is a factor that delays the materialization of difficulties.

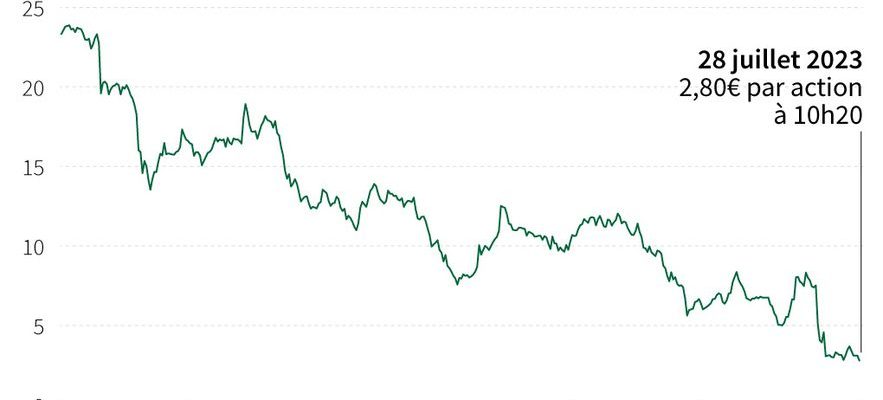

The fall of the Casino stock

© / afp.com/Valentin RAKOVSKY, Anibal MAIZ CACERES

The Casino share has lost 90% in three years, 68% since the start of the year… Can it fall further?

Mathematically, a stock that has lost 90% can still lose 90%! In this kind of situation, the small investors know that it is the end but they do not believe in it and we sometimes witness irrational behavior and overvalued shares. Professional investors are not fooled. Insofar as the existing shareholders will drop from 100% to 0.3% of the capital, the current price around 2.80 euros seems to me to be largely overvalued.

Do you believe in a Casino relaunch?

It’s a challenge. After the financial restructuring, the biggest thing to do will remain, that is to say the operational recovery of Casino, whose activity had been deteriorating for a long time. This company was long in debt, which hampered its ability to adapt to a changing world. Now that the subject of debt is settled, that changes the game.

Will Daniel Krestinsky and his partners be forced to launch a takeover bid on Casino?

On the occasion of a guaranteed capital increase, they will cross the 30% threshold, which in principle obliges them to launch a takeover bid on the rest of the capital. But the regulations of the Financial Markets Authority (AMF) provide that, in the case of a company in proven financial difficulty, an exemption from this obligation is possible. In the case of Casino, there is no subject, the AMF will most certainly grant this exemption.