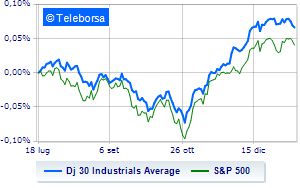

(Finance) – Caution prevails on Wall Street, with the Dow Jones which continues the session with a slight drop of 0.48%, continuing the bearish trail of three consecutive drops, which began last Friday; along the same lines, theS&P-500 loses 0.94%, continuing the session at 4,721 points. Down the Nasdaq 100 (-1.21%); as well as, in red theS&P 100 (-0.9%).

Investors’ attention remains focused on central banks. Insiders are betting on a first rate cut, as early as March, even though the governor of the Federal Reserve, Christopher Waller, has said there is no rush. Indications on the economy may come from the Beige Book this evening.

Investor sentiment is also affected by the increase in Treasury bond yields, with the 10-year bond returning above 4%, and the lower-than-expected growth of Chinese GDP, with consequent fears for the global economy.

In the S&P 500, no fund is saved. In the list, the worst performances are those of the sectors utilities (-1.92%), secondary consumer goods (-1.54%) e telecommunications (-1.28%).

Among the best Blue Chips of the Dow Jones, United Health (+2.07%) e Boeing (+1.21%).

The steepest declines, however, occur at Caterpillarwhich continues the session with -3.49%.

Prey for sellers Walgreens Boots Alliancewith a decrease of 3.00%.

They focus on sales Walt Disneywhich suffers a decline of 2.68%.

Sales up Intelwhich recorded a decline of 2.68%.

Between best performers of the Nasdaq 100, T-Mobile US (+0.78%) e Datadog (+0.75%).

The worst performances, however, are recorded on CrowdStrike Holdingswhich gets -4.40%.

Bad performance for ON Semiconductorwhich recorded a decline of 3.92%.

Black session for Microchip Technologywhich leaves a loss of 3.86%.

Negative session for Modernwhich shows a loss of 3.73%.