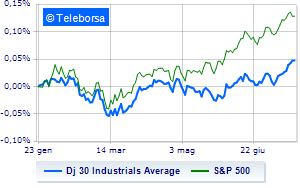

(Finance) – Positive start for the Wall Street Stock Exchange, in the aftermath of a mixed session. Investors are focused on the US quarterly and the monetary policy meetings of the Federal Reserve, European Central Bank and Bank of Japan, scheduled for next week. Still on the monetary policy front, today the Russian central bank raised the interest rate by 100 basis points, bringing it to 8.5% per annum.

Among US indices, the Dow Jones the session continues on the levels of the previous day and stops at 35,213 points, while, on the contrary, theS&P-500 proceeds in small steps, advancing to 4,550 points. Salt the NASDAQ 100 (+0.76%); on the same trend, fractional gains for theS&P 100 (+0.42%).

The sectors are distinguished in the S&P 500 basket informatics (+0.91%), telecommunications (+0.61%) and secondary consumer goods (+0.50%). Among the worst of the list of the S&P 500 basket, the sub-funds are decreasing the most materials (-0.51%) and financial (-0.43%).

To the top between Wall Street giants, Johnson & Johnson (+6.07%), Travelers Company (+1.80%), intel (+0.90%) and Chevrons (+0.86%).

The worst performances, however, are recorded on Salesforcewhich gets -2.65%.

On the podium of the Nasdaq stocks, ASML Holding (+2.49%), AirBnb (+1.99%), PDD Holdings (+1.95%) and JD.com (+1.91%).

The strongest sales, on the other hand, show up Sirius XM Radiowhich continues trading at -13.30%.

Letter about Applied materialswhich records a significant drop of 5.46%.

Goes down Intuitive Surgicalwith a drop of 3.99%.

CSX extension drops by 3.74%.