Nice surprise ! 2023 did not bode well and yet it was an excellent stock market year for large caps in general and more particularly for American technology giants. Result: the Nasdaq index of technology stocks jumped 43.4%, while the much broader Dow Jones gained 13.7%. An optimism which has also spread to the Old Continent. The Parisian CAC 40 index, like its euro zone counterpart, the Euro Stoxx 50, increased by 16.5% and 19.2% respectively.

NEW3789CT Eight stocks to put in your portfolio

© / The Express

However, on a geopolitical level, multiple tensions are plaguing the planet. The armed conflict between Israel and Hamas has continued for several months, at the risk of destabilizing the entire region. Allies of Hamas, Yemen’s Houthi rebels threaten merchant ships in the Bab-el-Mandeb Strait, a major maritime route towards the Suez Canal. If their attacks continue, they could increase the cost of freight and counteract the current decline in inflation.

On the other hand, everything suggests that the war between Ukraine and Russia will last and that aid from Western countries to kyiv will have to continue over time. Finally, tensions between China and the United States remain high and the American presidential election scheduled for November 5 only increases uncertainties.

On the economic level too, unpredictability remains the order of the day, even if the inflationary peak now seems to be behind us. “Growth is close to zero in Europe and it should slow down significantly in the United States,” reports Eric Bleines, Managing Director of Swiss Life Gestion Privée. If inflation continues to decline on these two continents and if the central banks decide to lower their key rates, the markets should generally move upwards.” A phenomenon that would help maintain this movement. “Until now,” continues Eric Bleines, “this increase was fueled by a handful of American technology giants, pioneers in artificial intelligence, such as Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.”

The specter of recession

Conversely, other factors could continue to fuel inflation in the long term. This is particularly the case for the energy transition, because producing green costs more. The same goes for deglobalization, which favors more local, but also more expensive, production. Finally, the aging of the Western population leads to a reduction in the number of active people in the labor market, which creates bottlenecks, which in turn encourage wage increases for qualified jobs.

Another source of questioning concerns the level of company margins. In 2023, companies demonstrated adaptability and responsiveness, posting increasing results, which enabled the stock market to perform well. But will it be the same in 2024? The specter of a recession, even temporary, would obviously affect their operational performance. “Added to this are questions about the refinancing of the debt of States and companies, observes Eric Bleines. Indeed, many bonds were issued in 2020, at very low rates, at a time when, due to of Covid, it was necessary to revive growth and production. They mature in 2024 and 2025. However, most of them will be repaid via the issuance of new bonds, but at much higher rates, which will increase costs. financial results of companies and will have an impact on their results.” Under such conditions, what will be the reaction of financial markets?

In this unstable environment, it is important to favor financially solid, well-managed companies positioned in dynamic markets, offering visibility regarding their future performance and displaying constant growth in their results. The Air Liquide group offers an excellent example. Producing gases for industry and the health sector, this company is managed by experienced management. Over 30 years, its net income per share has recorded an average annual growth of 6.8%. The same goes for stocks like Vinci, specializing in concessions, energy and construction; TotalEnergies, a key player in the energy sector, and LVMH, a luxury group with a rich range of prestigious brands.

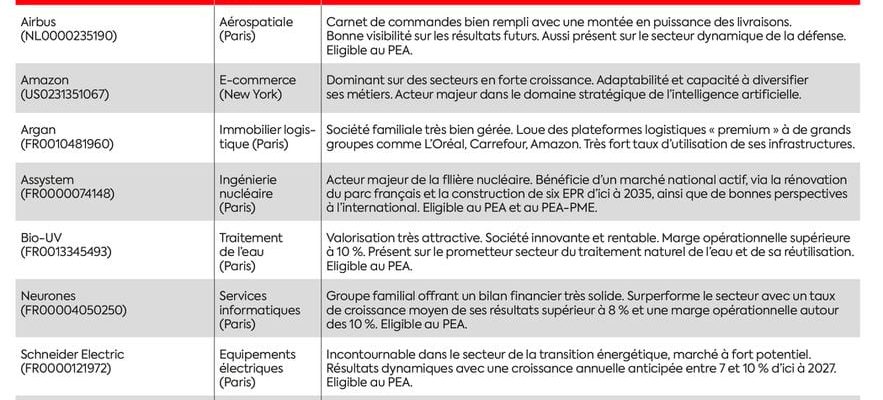

According to observers, two particular themes could prove promising, starting with that of security. With the increase in international tensions, this is at the heart of concerns, which favors successful companies in cybersecurity and defense such as Thales, Dassault and Airbus. It is also difficult to stay away from the deployment of artificial intelligence (AI). This major innovation should revolutionize our lives and the world of work. Even if their share price skyrocketed in 2023, the global giants promoting AI, like Amazon, Microsoft or Alphabet, offer more than ever great growth prospects for the decade to come.

Don’t forget SMEs!

There is also a card to play in areas of activity that have temporarily suffered from the economic situation. Logically, they should indeed regain color in 2024. This is particularly the case of the wine and spirits sector, with firms like Pernod Ricard and Rémy Cointreau, which have “toasted” because of the drop in consumption of alcohol in China and the commercial strategy of destocking their customers in the United States. Listed real estate companies could also rebound. “Particularly sanctioned in 2023 by the markets, they have started to recover, stimulated by the prospects of falling interest rates, notes Guillaume Buhours, analyst and fund manager at Gay-Lussac Gestion. But we must be selective and favor those which are positioned in a growing market, such as that of logistics platforms.”

Furthermore, banking groups like BNP Paribas and Société Générale are benefiting from the level of interest rates, which are higher than in the past. They should therefore show good results in 2024 to the extent that they improve their margins on loans granted to businesses and individuals. Same thing for insurers, like Axa, who now invest their cash at significantly more attractive rates of return.

Finally, small and medium-sized enterprises (SMEs) and mid-sized companies are also expected to rebound when the reduction in interest rates takes effect. The CAC PME index has in fact fallen by 21% in 2023, a difference of almost 40 points with the CAC 40, where we find the largest companies. “The discount of mid-caps compared to large caps is historically high and unjustified, underlines Guillaume Buhours. It is comparable to that recorded in 2008-2009 when the financial health and growth prospects of SMEs are much better today than ‘at that time.”

In this context, the calendar will be crucial and will determine the quality of the 2024 stock market year. The faster the drop in rates occurs, the more the stock market will turn green.

An article from the special report of L’Express “Investing in 2024: the right strategies in the face of an uncertain environment”, published in the weekly of February 15

.