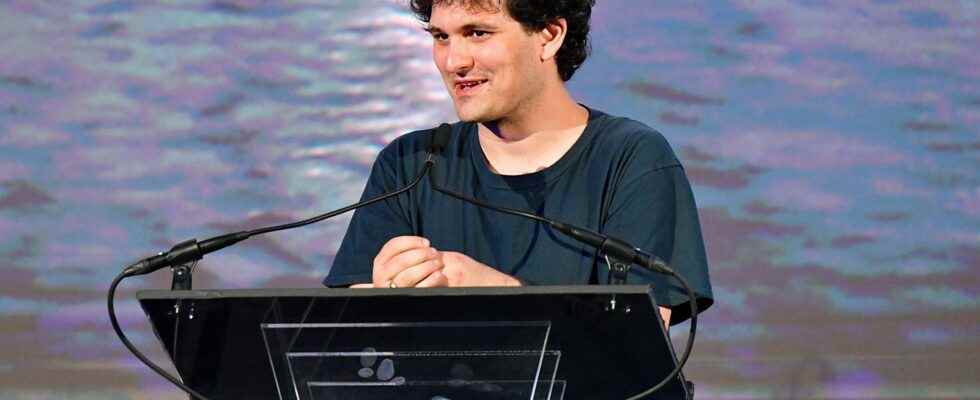

“Why isn’t he in jail yet?” Since the fall of the FTX cryptocurrency exchange on November 11, many aggrieved investors have wondered about the fate of its leader and founder Sam Bankman-Fried. From the Bahamas, the man who squandered around $30 billion in a handful of days was meticulously preparing his media outlets and his tweets to repent. Justice eventually caught up with him. The SEC, the policeman of the American financial markets, filed a complaint against “SBF”, who was arrested in the process, Monday, by the Bahamian authorities. “The Securities and Exchange Commission accuses Samuel Bankman-Fried of orchestrating a scheme to defraud stock investors of FTX Trading Ltd (FTX). Investigations into other securities law violations and other entities and individuals connected to the alleged misconduct are ongoing,” the agency noted. on its websitewhich speaks of 1.8 billion in funds raised by “SBF”, including 1.1 from a hundred investors based in the United States.

“We allege that Sam Bankman-Fried built a house of cards on a foundation of deception while telling investors it was one of the safest companies in crypto,” the chairman of the company said. SEC, Gary Gensler. On Tuesday, the New York federal prosecutor unveiled no less than eight counts against SBF, including electronic fraud, money laundering and violation of election laws. The Prime Minister of the Bahamas archipelago, Philip Davis, also communicated on an ongoing criminal investigation – FTX was registered in this tax haven. Questioned at the same time by a parliamentary committee of the House of Representatives, the liquidator John Ray III drove the point home, describing the so feverish structure on which FTX rested. In turn, he denounced the inexperience of the small management team, the total absence of documentation, the use of basic accounting software for small businesses – QuickBooks – more than unsuitable for a company that was brewing colossal sums, or the sums squandered in dubious investments (no less than 5 billion in 2021).

Do Kwon hunted, Binance scrutinized

If Bankman-Fried now risks life imprisonment, the so-called Do Kwon, he is still running. But the South Korean authorities have not given up trying to bring him before a court of law, revealed local media this week. The founder of the Terra/Luna tokens, which collapsed in the spring, causing a veritable “crypto-crash” in the process, would have been located in Serbia. No less than 350 investors have already filed a complaint, claiming more than 50 million dollars evaporated in nature. Something to spend time in the shade, like SBF.

“Crypto-justice” seems to pass for everyone. Including for another major player in the ecosystem, Changpeng Zhao, alias “CZ”, the new white knight in the middle. Its Binance exchange platform, the largest in the world, is also the subject of investigations by the American justice system, revealed on Monday Reuters news agency. Binance allegedly let Russian drug dealers and North Korean hackers transfer money anonymously. Binance is also accused of violating US sanctions on Iran by letting local entities operate crypto exchanges. Fortunately for CZ, the US Department of Justice still wants to accumulate evidence. An amicable agreement is expected. Binance formally denies all accusations. “Cryptography is NOT a safe haven for illicit activity […] In 2022, our team responded to more than 47,000 law enforcement requests, increased the number of security and compliance employees by more than 500%, participated in more than 70 cybercrime workshops with the forces of the world order”, defended the company in a press release.

Since the explosion of cryptocurrencies around 2017, many companies or actors have found themselves in the crosshairs of justice. The other major exchange platform, the American Coinbase, but also the lender Nexo, can testify to this. But the cases of SBF, Do Kwon, and if the lawsuits are confirmed, Binance, clearly show that the impunity that has sometimes reigned in this poorly regulated sector around the world is over. These cases also suggest, for the crypto community, its first major trials.