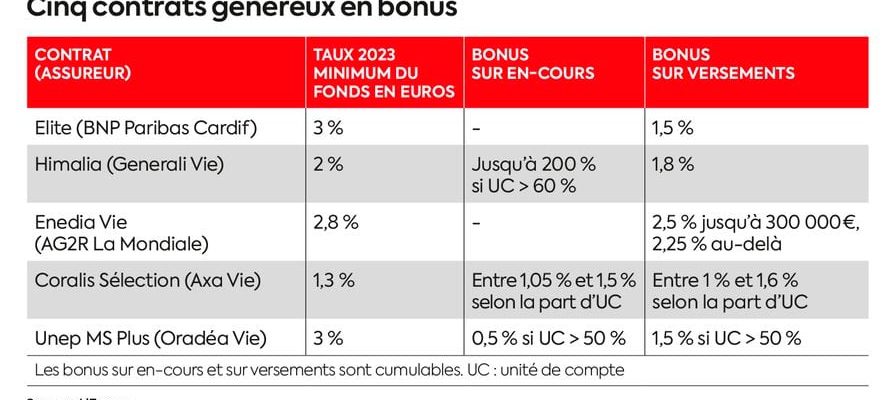

“For any payment or subscription until March 31, 2024, benefit from a bonus of +1.6% net of fees on our fund in euros.” Such promotional offers have been flourishing for several months on the websites of transport companies.life insurance. Professionals compete in ingenuity to encourage you to invest your savings in life insurance in euros.

NEW3789CT Five generous bonus contracts

© / The Express

However, a year earlier, the same people on the contrary encouraged investors to favor subscriptions in unit-linked units (UC), unguaranteed supports, subject to the vagaries of the financial or real estate markets. A real commercial pirouette justified by the clear increase in interest rates. From now on, interest rate products such as bonds and savings accounts are indeed recovering. Livret A offers a 3% return after tax, and the bonds pay an average return of between 4.5 and 9%.

However, euro funds are made up of 70 to 80% of bonds on average, with the remaining portion split between listed and unlisted equities and real estate. Insurers therefore want to reinvest massively in new bonds at attractive rates in order to “dilute” those they already have in their portfolio and bring in almost nothing. They therefore encourage savers to place their money in their euro funds. Problem: the average performance of the latter, estimated at 2.5% net for 2023, by the Facts & Figures barometer, is lower than that of booklets and bonds. To look better, some therefore apply a bonus to the returns obtained. If the insurer Oradéa Vie displays, for example, a minimum 2023 return of 3.1% net on the general assets of the Target + contract, this return jumps to 5.1% with the application of the maximum bonus.

How can we manage to offer bonuses while guaranteeing the capital invested? “Every year, the euro fund generates a return and the insurer can decide not to distribute everything to savers,” explains Lissa Wilms, executive director of the wealth management firm Angage Finances. “It takes a little each year and thus constitutes a reserve that it can use later to boost returns.” He has eight years to do it.

“A piece of advice: recover from your insurer or on the website Goodvalueformoney.eu the weight of your fund’s financial reserves in euros compared to its overall assets, recommends Lissa Wilms. The more important they are, the higher the professional will be able to offer a bonus and apply it over time. Knowing that a very good reserve level is around 7 to 8%.” And continues: “It is also interesting to look at the past results of the fund. Underperformance compared to the market is not necessarily a bad sign if the insurer has taken the opportunity to form a comfortable reserve that it can mobilize. Otherwise, be wary: its management is not excellent.”

Look carefully at the conditions for obtaining the bonus, which may differ from one insurer to another. Most will condition it on the UC proportion of your contract. For example, it will only be 0.4% if the latter contains between 10 and 30% UC; will amount to 0.8% if this proportion is between 30 and 50% and may exceed 1.5% beyond 50%. Others will link it to the amount of payments. Another important question to ask yourself: does this bonus apply only to payments or to the entire outstanding amount.

Good news: this trend should continue this year. In 2024 and 2025, rates could reach, with bonus, 5 to 5.5%. An excellent opportunity to seize to obtain returns while guaranteeing your capital.

An article from the L’Express special report “Investing in 2024: the right strategies for an uncertain environment”, published in the weekly on February 15.

.