(Tiper Stock Exchange) – Positive session for the Europeans, with investors welcoming signs from the Federal Reserve that inflationary pressures are easing. The focus today is on the decisions of the Bank of England and the European Central Bank expected throughout the day. In particular, the ECB should raise the cost of money by 50 basis points and bring deposit rates to 2.5%, the highest since November 2008.

In rally TIMafter the company confirmed it received from US giant KKR a non-binding offer to purchase the network. The government, through a note from the Ministry of Enterprise and Made in Italy, has made it known that it is closely following developments on KKR’s offer and has reiterated the objectives on employment protection and the security of the strategic infrastructure.

He suffers Sarasafter Angel Capital Management (director Angelo Moratti) signed a so-called “funded collar derivative contract” with Bank of America concerning the 5% of the capital social security of the company active in the oil refining.

Meanwhile, it is the season of quarterly reports in Europe has come to lifewith investor attention focused on big banks. Deutsche Bank reported a net profit of €5.7 billion in 2022, more than double the previous year and the best result since 2007. Eng reported a decline in annual profit of 23.1% to 3.67 billion euros, while Banco Santander reported a record profit of €9.6 billion in 2022.

On macroeconomic frontmixed data came from the performance of German foreign trade in December 2022, while unemployment rose in Spain in January 2023.

No significant change for theEuro / US Dollar, trading on the previous day’s values of 1.1. L’Gold shows a modest gain, with an increase of 0.33%. Weak session for petrolium (Light Sweet Crude Oil), which trades 0.03% lower.

The Spreads improves, reaching +187 basis points, with a decrease of 4 basis points compared to the previous value, with the yield of the 10-year BTP equal to 4.08%.

Among the markets of the Old Continent takes off Frankfurtwith an important increase of 1.54%, compounded Londonwhich grew by a modest +0.51%, and a modest performance for Pariswhich shows a moderate increase of 0.65%.

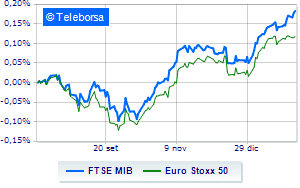

TO Business Squarethe FTSEMIB continues the day with an increase of 0.78%, to 26,913 points, continuing the bullish trail highlighted by three consecutive gains, triggered last Tuesday; on the same line, rising the FTSE Italia All-Share, which increases compared to the day before, reaching 29,147 points. Slightly positive the FTSE Italia Mid Cap (+0.53%); along the same lines, revved up the FTSE Italy Star (+1.62%).

At the top of the ranking of the most important titles of Milan, we find Telecom Italy (+8.97%), amplifier (+3.63%), STMicroelectronics (+3.31%) and Interpump (+2.65%).

The strongest sales, on the other hand, show up Leonardo, which continues trading at -1.83%. Prey of sellers Tenaris, with a decrease of 1.51%. Slow day for ENI, which marks a decrease of 0.72%. Small loss for General Bankwhich trades with -0.68%.

Among the protagonists of the FTSE MidCap, Reply (+4.55%), Sesa (+3.45%), wiit (+2.96%) and Tinexta (+2.89%).

The strongest sales, on the other hand, show up Saras, which continues trading at -5.95%. They focus their sales on OVS extension, which suffers a drop of 2.00%. Sales on Illimity Bank, which records a drop of 1.62%. Bad sitting for De Nora Industrieswhich shows a loss of 1.60%.