(Finance) – In the coming decades, the aging of the Italian population will lead to an increase in family spending on health and care, slowing down other consumption. Aging should negatively affect the level of consumption, other factors being equal, but the propensity to save could subsequently decline due to policies aimed at reducing the significant impact of aging on the public budget. This is what emerges from one research by the Studies and Research Department of Intesa Sanpaolo by the economist Luca Mezzomo.

In detail, the demographic projections for Italy indicate that in the next two decades the working age population will decrease by almost 4 million units. Employment, however, will be reduced by less than one million units thanks to the lengthening of the working age, the increase in the participation rate of older workers and the decline in the structural unemployment rate. On the other hand, the elderly and very elderly population will increase by 3.5 million, with a greater spread of medium and severe disabilities. Current demographic projections assume a net immigration rate of 0.5-0.6%. Aging should reduce potential growth both due to the lower dynamics of labor input and the possible repercussions on productivity growth. This impact – underlines the report – seems “underestimated in official projections”.

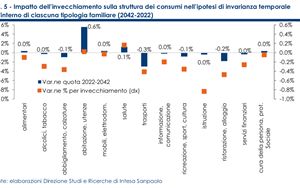

The aging of the population will have wide-ranging repercussions on the Italian economy. Considering the increase in social security spending, health spending and long-term care spending, the cost to the public budget estimated by the European Commission in 2021 ranges from a minimum of 1.9% to a maximum of 5.2% of GDP, even taking into account the decline in spending on education. The impact on the propensity to save looks positive, for now. However, the Japanese experience suggests that in the future the net effect will become negative, both due to the lower generosity of public social security treatments and the greater need for healthcare and healthcare spending. The increase in demand for health and care services and the higher incidence of housing costs will weigh on composition of household consumptionreducing the shares of clothing, footwear, transportation, education, entertainment, restaurants and hotels.

Intesa Sanpaolo plans one reduction in the share of purchases of goods and an increase in the share spent on services, but concentrated in a few categories. In the euro area, 2010 data show that health represented 4% of consumption for the over-60s, compared to 2% for the under-60s; housing costs 34%, compared to 27% for the under-60s; instead, young people spent more on clothing (6% against 4%) and on transport (15% against 10%)8. In Japan, where the aging of the population is more advanced than in Italy, in 2021 health expenses represent 6.3% of the total for single elderly people over 60, compared to 3% for single young people and 4 .1% for individuals aged 35-59; the share dedicated to culture/recreation, transport/communication and clothing was lower by 5.4 percentage points compared to the 35-59 age group. The growth in housing costs reflects the greater frequency of single people or couples without children living together among families with an elderly reference person, often domiciled in oversized properties, because they were acquired when the family unit was larger.

For Italy, the foreseeable movement of expenditure shares between 2022 and 2040 is very limited: the health spending goes from 4.3% to 4.5% between 2022 and 2040, the share of transport drops from 10.1% to 9.8% and the housing expenses they rise from 38.5 to 39% of the total. There share of goods and services for the person (which includes heterogeneous categories, correlated in opposite ways with age) rises only marginally. Assuming a real average growth in consumption of 0.7% per year, the impact of aging would not be sufficient to reduce the value at constant prices in any of the spending chapters, but for some of them the deviation from the average path would be however very important.

“It is foreseeable – concludes the report – that in the next two decades economic and social policies aimed at containing the impact of aging on public finances will add to the effects of the change in the demographic structure, determining a further shift of consumption from goods to health services and housing services. Some services will also be penalized by the demographic transition, such as transport, restaurants and hotels. In the more aggressive scenarios of an increase in private spending on health, linked to more restrictive policies for the provision of services, one could also observe a reduction in the propensity to save, in addition to a greater compression of consumption other than those linked to the need for health and assistance”.