(Finance) – Downward ending for the main European stock exchanges with investors doubtful about the ECB’s next monetary policy moves, after the president Christine Lagarde she said she was convinced that rates at 4% “for long enough” will tame inflation, thus extinguishing the hopes of those who expected a rapid decline. Among the squares of the Old Continent, Milan is weakwaiting for the rating agency Fitch publish your review of Italy’s creditworthiness.

On the other hand, the Wall Street stock market moved slightly higher with theS&P-500 which highlights an increase of 0.66% despite the fact that the number one of the Federal Reserve, Jerome Powellstressed that he is not sure whether the central bank’s position is sufficient to bring inflation back to the 2% target.

On the currency market, theEuro / US Dollar the session continues at the levels of the day before, reporting a change of -0.02%. Losing groundgold, which trades at 1,939 dollars an ounce, retracing by 1.00%. Rain of purchases on oil (Light Sweet Crude Oil), which shows a gain of 2.37%.

On equality, yes spreadwhich remains at +179 basis points, with the yield on the 10-year BTP standing at 4.50%.

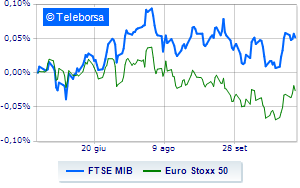

Among the main European stock exchanges slips Frankfurtwith a clear disadvantage of 0.77%, in the red Londonwhich highlights a sharp decline of 1.28%, and the negative performance of Paris, which falls by 0.96%. The Milanese price list closes the session just below parity, with the FTSE MIB which shaves 0.49%; on the same line, it is positioned below the parity line FTSE Italia All-Sharewhich stops at 30,414 points.

The value of trades on the Milan Stock Exchange on 10/11/2023 remains around the levels of the day before: from the closing data, it appears in fact that the total value was equal to 2.13 billion euros, with a variation of 1. 86%, compared to the previous 2.17 billion.

At the top of the ranking of the most important titles of Milan, we find Leonardo (+4.68%), Generali Insurance (+0.74%) e Tenaris (+0.73%).

The steepest declines, however, occurred on DiaSorinwhich closed the session at -4.03%.

Sales galore Campariwhich suffers a decrease of 3.83%.

CNH Industrial drops by 3.29%.

Decline decided for Monclerwhich marks -3.1%.

Between best stocks in the FTSE MidCap, GVS (+4.12%), Saras (+3.94%), Buzzi Unicem (+1.77%) e Banca Popolare di Sondrio (+1.27%).

The steepest declines, however, occurred on Antares Visionwhich closed the session at -5.89%.

Under pressure Zignago Glasswith a sharp decline of 3.69%.

He suffers Tod’swhich highlights a loss of 3.24%.

Prey for sellers De Nora Industrieswith a decrease of 3.21%.