(Finance) – After a decidedly negative start, European stock exchanges recovered ground during the session, although many did closed below par. Closing below par for Atlantiawith the Benetton family and the US investment fund Blackstone that could launch a takeover bid already tomorrow. Yesterday the stock hit a two-year high. Flat seat for Banco BPMwhich today exercised the option to purchase an 81% stake in the Bipiemme Vita insurance joint venture from Covea.

Meanwhile, the expectation for the ECB meeting scheduled for Thursday 14 April. “We believe this month’s ECB meeting is unlikely to end with a decisive change in monetary policy. However, they will be signs of normalization confirmedas the ECB is increasingly concerned about the current inflation dynamics, “said Annalisa Piazza, Fixed-Income Research Analyst at MFS Investment Management.

On the American market there has been ample progress for theS & P-500. Slight drop inEuro / US dollar, which drops to 1.086. L’Gold the session continues on the upside and advances to $ 1,974.4 per ounce. Euphoric session for crude oil, with oil (Light Sweet Crude Oil) showing a jump of 6.95%.

On the levels of the eve it spreadwhich remained at +162 basis points, with the yield on the ten-year BTP standing at 2.41%.

In the European stock market scenario modest descent for Frankfurtwhich yields a small -0.48%, thoughtful Londonwith a fractional drop of 0.55%, and hesitates Pariswith a modest decline of 0.28%.

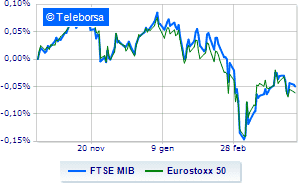

Caution prevails in closing in Piazza Affari, with the FTSE MIB which closes the session with a slight decrease of 0.33%; on the same line, the FTSE Italia All-Sharewhich stops at 26,997 points.

On parity the FTSE Italia Mid Cap (-0.11%); on the same trend, without direction the FTSE Italia Star (-0.03%).

At Piazza Affari, the turnover in today’s session was equal to 2.2 billion euros, down 9.58%, compared to 2.43 billion on the eve of the day; as regards volumes, these amounted to 0.52 billion shares, compared to the previous 0.73 billion.

Among the best Blue Chips of Piazza Affari, takes off Tenariswith an important increase of 3.23%.

In evidence Leonardowhich shows a strong increase of 2.74%.

It stands out Ferrari which marks an important increase of 2.48%.

Fly Nexiwith a marked rise of 2.37%.

The worst performances, however, were recorded on Unicreditwhich closed at -3.86%.

Thud of BPERwhich shows a 3.19% drop.

Letter on DiaSorinwhich records a significant decline of 2.71%.

Goes down Ternawith a decline of 2.35%.

Between best stocks in the FTSE MidCap, Antares Vision (+ 3.92%), Alerion Clean Power (+ 3.48%), Saint Lawrence (+ 2.99%) e Brunello Cucinelli (+ 2.33%).

The strongest declines, on the other hand, occurred on Banca Popolare di Sondriowhich closed the session at -2.50%.

Collapses Italmobiliarewith a decrease of 2.50%.

Sales hands on OVSwhich suffers a decrease of 2.43%.

De ‘Longhi drops by 1.98%.