(Finance) – A mixed session is confirmed on Wall Street where the attention of insiders is focused in particular on employment report coming this week while they look forward to news from negotiations between Russia and Ukrainein Turkey

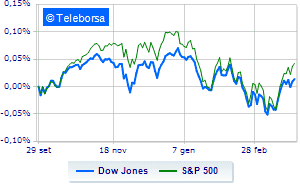

Among the US indices, the Dow Jones trades with a drop of 0.51%, while, on the contrary, theS & P-500 (New York), which is positioned at 4,537 points, close to the previous levels. Just above parity the Nasdaq 100 (+ 0.45%); almost unchanged theS&P 100 (+ 0.02%).

The sector is in good evidence in the S&P 500 secondary consumer goods. In the lower part of the S&P 500 ranking, significant declines are manifested in the sectors power (-2.80%), financial (-1.18%) e materials (-1.10%).

Among the best Blue Chips of the Dow Jones, Wal-Mart (+ 1.63%) e Microsoft (+ 1.23%).

The strongest sales, on the other hand, show up on Chevronwhich continues trading at -2.30%.

Decline for JP Morganwhich marks a -1.83%.

Under pressure Walt Disneywith a sharp decline of 1.79%.

Suffers Intelwhich shows a loss of 1.71%.

On the podium of the Nasdaq titles, Tesla Motors (+ 7.95%), Okta (+ 4.08%), Atlassian (+ 3.90%) e Constellation Energy (+ 3.77%).

The worst performances, on the other hand, are recorded on Skyworks Solutionswhich gets -3.00%.

Bad performance for Nxp Semiconductors NVwhich recorded a decline of 2.67%.

Black session for O’Reilly Automotivewhich leaves a loss of 2.61% on the table.

At a loss Marvell Technologywhich drops by 2.15%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Monday 28/03/2022

14:30 USA: Wholesale stocks, monthly (previous 1.1%)

Tuesday 29/03/2022

15:00 USA: S&P Case-Shiller, annual (expected 18.3%; previous 18.6%)

15:00 USA: FHFA house price index, monthly (previous 1.2%)

4:00 pm USA: Consumer confidence, monthly (107 points expected; previous 110.5 points)

Wednesday 30/03/2022

14:15 USA: ADP employed (expected 438K units; previous 475K units).