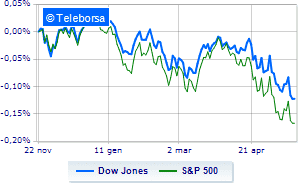

(Finance) – After a successful starteven today’s has quickly turned into one “bad day” for the US Stock Exchangedown by 1.10% on Dow Jonescontinuing the series of three consecutive declines that began last Wednesday, and with widespread sales on theS & P-500, which continues the day at 3,850 points (-1.35%). The S&P 500 is headed for his seventh weekly decline, which would make it the longest streak since the dotcom bubble. The bad Nasdaq 100 (-1.93%); with a similar direction, negative changes for theS&P 100 (-1.26%).

All the sectors. In the list, the sectors secondary consumer goods (-3.02%), industrial goods (-2.00%) e informatics (-1.63%) are among the best sellers.

With regard to who disseminated the quarterlysinks Deere (with supply-chain pressures impacting production) and it flies Palo Alto Networks (after he raised his guidance again, following a positive quarter). salt Foot Lockerwhich is estimated to reach the high end of the 2022 guidance.

At the top of the ranking of American giants components of the Dow Jones, Merck (+ 1.22%), Cisco Systems (+ 0.64%), Amgen (+ 0.55%) e Johnson & Johnson (+ 0.55%).

The strongest sales, on the other hand, show up on Boeingwhich continues trading at -6.36%.

Collapses Caterpillarwith a decrease of 4.29%.

Sales hands on Intelwhich suffers a decrease of 2.70%.

Bad performance for Home Depotwhich recorded a decline of 2.20%.

Between protagonists of the Nasdaq 100, Palo Alto Networks (+ 7.50%), Crowdstrike Holdings (+ 3.13%), Zscaler (+ 2.64%) e Biogen (+ 1.60%).

The worst performances, on the other hand, are recorded on Ross Storeswhich gets -23.94%.

Black session for Tesla Motorswhich leaves a loss of 7.77% on the table.

At a loss Dollar Treewhich falls by 7.00%.

Heavy Lucidwhich marks a drop of as much as -6.77 percentage points.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Tuesday 24/05/2022

15:45 USA: Composite PMI (preceding 55.1 points)

15:45 USA: Manufacturing PMI (preceding 59.2 points)

15:45 USA: SME services (preceding 55.6 points)

4:00 pm USA: New house sales, monthly (previously -8.6%).