(Finance) – The New York Stock Exchange remains at around parity, after the strong drops on the eve due to the key data on American inflation, which was higher than expected. The statistic prompted traders to further scale back bets on an upcoming interest rate cut by the Federal Reserve.

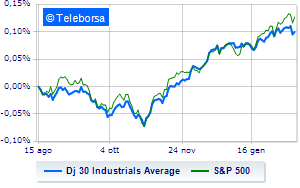

Among US indices, the Dow Jones stands at 38,244 points, while, on the contrary, theS&P-500 advances fractionally, reaching 4,968 points. Slightly positive Nasdaq 100 (+0.42%); consolidates the levels of the day beforeS&P 100 (+0.14%).

The sectors highlighted on the North American S&P 500 list industrial goods (+1.11%), telecommunications (+0.66%) e materials (+0.46%). In the list, the worst performances are those of the sectors office consumables (-0.69%) e power (-0.48%).

Among the best Blue Chips of the Dow Jones, Salesforce (+2.55%), Intel (+2.22%), Caterpillar (+1.47%) e Cisco Systems (+1.07%).

The strongest sales, however, occur at Applewhich continues trading at -1.11%.

Disappointing Procter & Gamblewhich lies just below the levels of the day before.

Lame Johnson & Johnsonwhich shows a small decrease of 0.73%.

Modest descent for Boeingwhich drops a small -0.65%.

To the top between Wall Street tech giantsthey position themselves Illuminate (+5.24%), Datadog (+4.47%), Zscaler (+3.93%) e Netflix (+3.63%).

The steepest declines, however, occur at Kraft Heinzwhich continues the session with -6.35%.

Sales up Biogenwhich recorded a decline of 2.27%.

Negative session for AirBnbwhich shows a loss of 1.94%.

Thoughtful Charter Communicationswith a fractional decline of 1.49%.

Among the data relevant macroeconomic factors on US markets:

Wednesday 02/14/2024

4.30pm USA: Oil inventories, weekly (expected 3.3 million barrels; previously 5.52 million barrels)

Thursday 02/15/2024

2.30pm USA: Empire State Index (expected -12.5 points; previously -43.7 points)

2.30pm USA: PhillyFed (expected -8 points; previously -10.6 points)

2.30pm USA: Import prices, monthly (expected -0.1%; previously 0%)

2.30pm USA: Unemployment Claims, weekly (expected 220K units; previously 218K units).