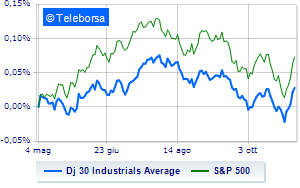

(Finance) – Wall Street continues the session higherwith the Dow Jones which advances to 34,125 points (+0.83%), continuing the positive series that began last Monday; on the same line, risingS&P-500, which increases compared to the day before, reaching 4,365 points (+1.10%). Positive the Nasdaq 100 (+1.23%); along the same lines, in money theS&P 100 (+0.88%). The data on the labor market, which showed that The US economy added fewer jobs than expected in Octoberboosting investors’ hopes that the Federal Reserve is done raising interest rates.

In particular, according to data published by the Bureau of Labor Statistics, 150 thousand jobs were added in the non-agricultural sectors (non-farm payrolls) in October, after 297 thousand payrolls had been created in September, while analysts expected an increase of 180 thousand jobs. Furthermore, the unemployment rate increased slightly to 3.9%, compared to 3.8% the previous month and the 3.8% consensus.

Among the US giants that have released i results before openingstand out Restaurant Brands (which reported growing revenues and declining profit in the third quarter of 2023), Cboe (which reported a better-than-expected third quarter thanks to strong trading volumes) and Block (which raised full-year guidance and announced a $1 billion buyback).

Weak Appleafter he published a last night weak revenue forecast for the current quarter (blaming weak demand for iPads and wearables, especially in the key market of China), despite posting above-expected results in the latest quarter, even as overall sales fell for the fourth consecutive quarter.

Positive result in the S&P 500 basket for i sectors materials (+1.71%), financial (+1.63%) e utilities (+1.42%). At the bottom of the ranking, significant declines are evident in the sector powerwhich reports a decline of -1.04%.

Between protagonists of the Dow Jones, Goldman Sachs (+4.24%), Walt Disney (+2.91%), Walgreens Boots Alliance (+2.70%) e 3M (+2.44%).

The steepest declines, however, occur at Chevron, which continues the session with -1.14%. Slow day for Apple, which marks a decline of 0.90%. Small loss for Procter & Gamblewhich trades at -0.64%.

On the podium of Nasdaq stocks, Modern (+8.33%), Monster Beverage (+7.34%), Sirius XM Radio (+7.20%) e Warner Bros Discovery (+6.18%).

The strongest sales, however, occur at Fortinet, which continues trading at -14.41%. Goes down Atlassian, with a decline of 4.36%. He suffers Palo Alto Networks, which highlights a loss of 2.82%. Prey for sellers Paychexwith a decrease of 1.96%.