(Finance) – The New York Stock Exchange remains at parity in what promises to be a week full of data with consumer confidence and inflation expected in the coming days. In the meantime, the spotlight remains on central banks: the Fed’s number one, Jerome Powell, is expected to speak on Friday.

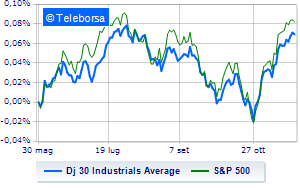

The Dow Jones stands at 35,332 points; on the same line, theS&P-500 (New York), which is positioned at 4,557 points, close to previous levels. In fractional progress the Nasdaq 100 (+0.22%); on equality theS&P 100 (+0.01%).

The sectors highlighted on the North American S&P 500 list secondary consumer goods (+0.64%) e informatics (+0.41%). In the list, the worst performances are those of the sectors power (-1.06%), healthcare (-0.69%) e industrial goods (-0.58%).

Among the best Blue Chips of the Dow Jones, 3M (+1.25%), Intel (+0.98%), Wal-Mart (+0.67%) e Home Depot (+0.65%).

The strongest sales, however, occur at Walgreens Boots Alliancewhich continues trading at -3.12%.

Basically weak Chevronwhich recorded a decline of 1.24%.

It moves below parity Amgenhighlighting a decrease of 1.10%.

Moderate contraction for Dowwhich suffers a drop of 0.90%.

Between best performers of the Nasdaq 100, MercadoLibre (+4.20%), Trade Desk (+3.61%), LamResearch (+1.79%) e Micron Technology (+1.73%).

The steepest declines, however, occur at GE Healthcare Technologieswhich continues the session with -3.55%.

In red Walgreens Boots Alliancewhich highlights a sharp decline of 3.12%.

The negative performance of Illuminatewhich drops by 2.70%.