(Finance) – Wall Street is moving cautiously after the previous week’s rally, with investors placing bets that interest rates have peaked following the FOMC’s decision to leave rates unchanged at its last meeting. Those expectations will be put to the test this week by a series of speeches by Fed officialsincluding President Jerome Powell, but also Lisa Cook, John Williams and Lorie Logan.

However, there are those who believe that the stock rally will not last. The analysts of Morgan Stanley they wrote that “stock indexes posted their strongest weekly rally all year, led by many of the year-to-date laggards. While we’ll keep an open mind, the move so far looks more like a bear market rally rather than l “the beginning of a sustained recovery, especially in light of earnings revisions and weaker macro data.”

Meanwhile, investors and analysts continue to monitor the signals that arrive from the quarterly reports. According to calculations by Wells Fargo, S&P500 companies’ EPS has been about 7% above consensus so far in the third quarter, largely driven by strength in margins as sales are below recent quarterly trends. “Despite 80% of companies beating EPS expectations, i guidance trends are disappointing and point to a cautious fourth quarter,” the analysts wrote in a note.

Walt Disney, Instacart And Biogen I’m among them major companies releasing data this week. Before today’s bell, BioNTech announced that it had cut its annual revenue guidance due to a decline in demand for the COVID vaccine, while Brookfield Asset Management said it is on track for a 2023 raise of $150 billion.

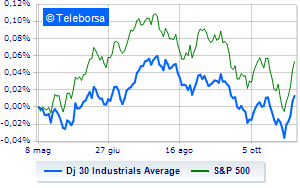

Looking at the main indicesWall Street reports a change of +0.12% on Dow Jones; along the same lines, a day without infamy and without praise for theS&P-500, which remains at 4,367 points. Moderately rising Nasdaq 100 (+0.44%); with a similar direction, slightly positiveS&P 100 (+0.38%).

Between macroeconomic quantities most important of the US markets:

Tuesday 07/11/2023

2.30pm USA: Trade balance (expected -$60.3 billion; previously -$58.3 billion)

Wednesday 08/11/2023

4:00 pm USA: Wholesale inventory, monthly (expected 0%; previously -0.1%)

Thursday 09/11/2023

2.30pm USA: Unemployment Claims, weekly (expected 215K units; previously 217K units)

Friday 10/11/2023

4:00 pm USA: Michigan University Consumer Confidence (expected 65 points; previously 63.8 points).