3 million French people use this tax system which is not directly recorded on the declaration.

This is the most used tax reduction in France. More than three million people use it every year. However, unlike a good amount of financial information on taxpayers, this is not automatically completed on the declarations of French people who have used it. Which may come as a surprise as its use is widespread across the country. This is therefore a particular point of vigilance when completing your form.

Between 1er January and December 31, 2023, you may have, like nearly 10% of taxpayers, made a donation to organizations helping people in difficulty, of general interest, to public utility associations, to candidates for elections, to political parties or even for the safeguarding of religious heritage. This gesture of support for a cause is above all an opportunity to lower the amount of taxes.

In fact, the tax administration deducts 66 to 75% of the amount of your donation from the total bill. For example, if you donated 100 euros and the amount that you initially still had to pay in taxes was 566 euros, this is lowered to 500 euros thanks to your donation. But be careful, it is up to you to inform the DGFiP of your approach.

This is done in two steps when completing your tax return. At the start of the form, a page entitled “Select the sections below that you wish to appear” is displayed. You must scroll down to the “Charges” section and check “Tax reductions and credits: donations, childcare costs, home-based employment, union dues, compensatory benefits, etc.”

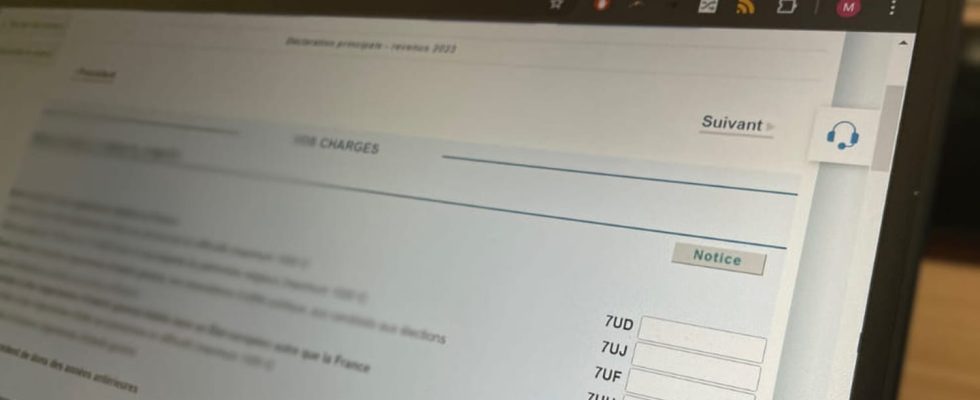

Then, it is on the “Your charges” page that the line to complete appears. In one of the boxes in the “Donations paid to organizations established in France” section, you must enter the total amount of your donation in the box corresponding to the establishment to which you made your donation. Here are which organizations each box corresponds to:

- 7UD: Restos du cœur, Secours populaire, Secours catholique, Salvation Army, ACF, MSF, Médecins du Monde, Red Cross, organizations helping victims of domestic violence

- 7UJ: Heritage Foundation

- 7UF: General interest organizations, public utility associations, election candidates

- 7UH: Political parties

The tax reduction is then calculated automatically. On the last page “Summary of your declaration”, you can check the amount of the reduction by clicking on “Consult the calculation details”, in the “Tax reductions” line.