(Finance) – Earnings day for the New York Stock Exchange, after the IMF has revised down the growth forecasts for the USA in a more contained way compared to the European economies, more affected by the fallout from the war in Ukraine and the sanctions against the Russia.

The attention of the insiders is catalyzed by inflation after the words of Bullard, president of the Saint Louis Fedwhich did not rule out rate hikes of more than 50 basis points.

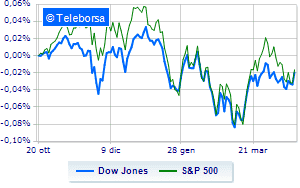

Among the US indices, the Dow Jones shows a gain of 1.16%; along the same lines, positive performance forS & P-500, which continues the day with an increase of 1.25% compared to the end of the previous session. Excellent performance of the Nasdaq 100 (+ 1.71%); on the same trend, positiveS&P 100 (+ 1.18%).

The sub-funds are highlighted on the North American S&P 500 list secondary consumer goods (+ 2.51%), telecommunications (+ 1.85%) e industrial goods (+ 1.59%). At the bottom of the ranking, significant falls are manifested in the sector powerwhich reports a decrease of -0.63%.

Between protagonists of the Dow Jones, Boeing (+ 4.12%), Nike (+ 4.10%), Walt Disney (+ 3.91%) e Johnson & Johnson (+ 2.96%).

The worst performances, however, are recorded on Travelers Companywhich gets -5.58%.

Chevron drops by 1.19%.

Modest descent for Merckwhich yields a small -0.93%.

On the podium of the Nasdaq titles, Okta (+ 7.42%), Atlassian (+ 6.60%), Docusign (+ 6.53%) e Intuitive Surgical (+ 6.39%).

The strongest falls, on the other hand, occur on Modernwhich continues the session with -3.79%.

Negative sitting for JD.comwhich drops by 2.11%.

Decline for Pinduoduo Inc Spon Each Repwhich marks a -1.32%.

Thoughtful Astrazenecawith a fractional decline of 0.82%.

Between macroeconomic quantities most important of the US markets:

Wednesday 20/04/2022

4:00 pm USA: Sale of existing homes, monthly (previous -7.2%)

16:30 USA: Oil stocks, weekly (863K barrels expected; previous 9.38 Mln barrels)

Thursday 21/04/2022

14:30 USA: PhillyFed (20 points expected; preceding 27.4 points)

14:30 USA: Unemployment Claims, Weekly (Expected 175K Units; Previously 185K Units)

4:00 pm USA: Leading indicator, monthly (expected 0.3%; previous 0.3%).