(Finance) – Last session of the week on the rise for the New York Stock Exchange, despite the words of the chairman of the Federal Reserve, Jerome Powell, in an interview with Marketplace. The number one of the US central bank noted that with a tight labor market pushing wages higher, avoiding a recession that often follows a tightening of aggressive policies will be a challenge. Powell said he understands the backlash higher rates can cause, but he did not rule out that the Fed must act aggressively.

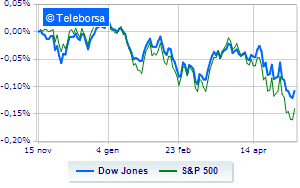

Among the US indices, the Dow Jones shows a gain of 0.77%, thus blocking the bearish trail supported by six consecutive drops, which started on the 5th of this month; on the same line, theS & P-500 it gained 1.16% compared to the previous session, trading at 3,976 points. High on the Nasdaq 100 (+ 1.66%); with the same direction, theS&P 100 (+ 1.1%).

Secondary consumer goods (+ 2.11%), power (+ 2.07%) e informatics (+ 1.47%) in good light on the S&P 500 list.

To the top between giants of Wall Street, Salesforce (+ 2.93%), Boeing (+ 2.81%), American Express (+ 2.69%) e Walt Disney (+ 2.07%).

The worst performances, on the other hand, are recorded on Amgenwhich gets -0.54%.

Between best performers of the Nasdaq 100, Lucid (+ 7.33%), Docusign (+ 7.00%), Zoom Video Communications (+ 6.96%) e Baidu (+ 6.41%).

The strongest falls, on the other hand, occur on Amgenwhich continues the session with -0.54%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 13/05/2022

14:30 USA: Import prices, monthly (expected 0.6%; previous 2.9%)

14:30 USA: Export prices, monthly (expected 0.7%; previous 4.1%)

4:00 pm USA: University of Michigan Consumer Trust (expected 64 points; preceded 65.2 points)

Monday 16/05/2022

14:30 USA: Empire State Index (preceding 24.6 points)

Tuesday 17/05/2022

14:30 USA: Retail sales, annual (previously 6.9%).