(Finance) – With reference to the treasury share buyback program approved by the Shareholders’ Meeting on April 29, 2022 and subsequently approved by the Board of Directors on November 14, 2022, Salcef Group reported that he has purchasedbetween 27 and 30 December 2022 inclusive, overall 26,513 ordinary treasury shares for a counter value equal to 460,038.71 euros.

Further to what has already been communicated, the purchases, for a maximum amount of 300,000 shares, have the purpose of:

have treasury shares to be allocated to service the “2021-2024 Stock Grant Plan”, the “2022-2025 Stock Grant Plan”, the “2022-2023 Performance Shares Plan”, as well as any future incentive plans in order to to incentivize and retain employees, collaborators, directors of the Company, subsidiaries and/or other categories of subjects chosen at the discretion of the BoD; carry out successive transactions for the purchase and sale of shares, within the limits permitted by accepted market practices; set up a so-called “securities warehouse”, useful for any future extraordinary finance operations; make a medium and long-term investment or in any case

in order to seize the opportunity to make a good investment, also in consideration of the risk and expected return of alternative investments and also through the purchase and resale of shares whenever appropriate; use excess liquid resources.

Following the purchases indicated above, as at 30 December Salcef held 538,257 treasury shares, equal to 0.863% of the share capital.

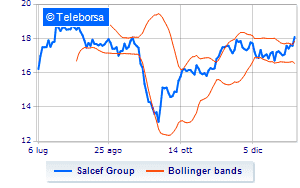

Meanwhile, on the Stock Exchange, the Group that operates in the development and innovation of infrastructures for sustainable mobility shows an unchanged trend compared to the day before, and stands at 18.08 euros.