(Finance) – Start of the week marked by prudence for the Wall Street stock exchange with the attention of investors catalyzed by news from the M&A front that boost some titles. As Peloton (+ 27%) after some rumors that both Amazon and Nike are considering the option of submitting an offer to take over the group. Also shop on Spirit Airlines after the airline announced the purchase of rival Frontier in a deal valued at $ 6.6 billion, including debt.

No relevant macroeconomic data is expected for today while the January employment report, released Friday, featured one growth of new jobs higher than expected from the market.

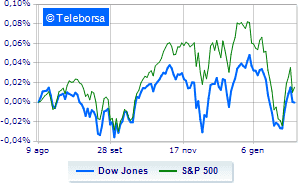

On the first observations, the Dow Jones it is stable and ranks on 35,072 points; on the same line, day without infamy and without praise for theS & P-500, which remains at 4.505 points. On the levels of the eve the Nasdaq 100 (+ 0.07%); on the same trend, consolidates the levels of the eve of theS&P 100 (+ 0.11%).

The sector is in good evidence in the S&P 500 secondary consumer goods. Among the worst on the list of the S&P 500 basket, the sectors showed the greatest decline power (-0.95%) e utilities (-0.53%).

At the top of the ranking of American giants components of the Dow Jones, Walt Disney (+ 1.26%) e Salesforce.Com (+ 0.67%).

The strongest falls, on the other hand, occur on Verizon Communication, which continues the session with -0.89%.

Undertone Travelers Company which shows a filing of 0.71%.

Disappointing Johnson & Johnson, which lies just below the levels of the eve.

Lazy Chevron, which shows a small decrease of 0.63%.

Between protagonists of the Nasdaq 100, American Airlines (+ 2.19%), Tripadvisor (+ 1.48%), Wynn Resorts (+ 1.29%) e Tractor Supply (+ 1.19%).

The worst performances, on the other hand, are recorded on Garmin, which gets -6.00%.

In red Modern, which shows a marked fall of 1.01%.

The negative performance of CHRobinson, which falls by 1.01%.

Modest descent for Henry Schein, which yields a small -0.97%.