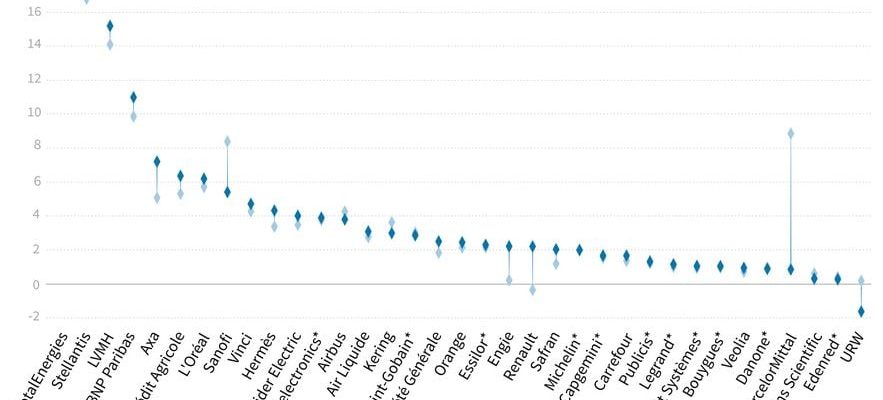

Against all odds, large French companies recorded an increase in their profits and even came close to their historic record. While the global economy is undermined by geopolitical rivalries (Ukraine, Middle East) as well as the energy and inflationary crises, the CAC 40 companies have revealed their accounts, and confirmed their Olympic form. The 35 companies that have already revealed their accounts made nearly 144.2 billion euros in net profits in 2023. Figures higher than those recorded by the entire CAC 40 in 2022, estimated at nearly 142 billion.

Highly awaited by investors, the publication of the financial results of these large firms confirms the very good health of the energy, banking, luxury and automobile sectors. TotalEnergies made the biggest profit (19.8 billion euros), almost stable compared to 2022. On the luxury side, LVMH, l’Oréal, Kering and Hermès shine, accumulating nearly 29 billion euros. euros. Results up 7% over one year, yet penalized by a decline of 17% suffered at Kering.

The horizon is also clear in the banking sector, favored by the rise in rates led by central banks with the aim of stifling the inflationary shock. Société Générale, Crédit Agricole and BNP Paris saw their combined profits increase by 17%, reaching almost 20 billion euros. Likewise, the automobile sector is holding up. Stellantis published the second biggest stock index result of the year, posting a record profit of 18.6 billion euros. Renault saw its profits reach nearly 2.2 billion euros.

A graph showing the net results of the group of 35 CAC 40 companies published as of February 29, 2024.

© / LAURENCE SAUBADU, SYLVIE HUSSON / AFP

2023, year of continuity

2023 stands out as a year of continuity, being the third year in a row where the companies in the flagship index of the Paris Stock Exchange have, collectively, made more than 100 billion euros in profits. The cumulative turnover reached 1.678 billion euros, down slightly compared to 2022 (1.721 billion euros). This great dynamic followed the results recorded in 2020, a year when activity was penalized by the Covid-19 pandemic. The profits of the 40 largest French companies listed on the stock exchange only stood at 34 billion euros, far from the pharaonic amounts now recorded.

The 2023 balance sheet should, however, not reach the historic figures recorded in 2021 (157 billion euros). That year, the CAC 40 was boosted by the spectacular profit recorded by Vivendi – more than 25 billion euros -, enabled by the sale of Universal Music. Other companies have not yet published their results such as Vivendi and Thales. But according to analysts surveyed by Factset, a financial data provider, these firms should see their profits also increase over one year, from 0.7 to 2.5 billion euros.

For the year 2024, companies “remain rather optimistic” observes Emmanuel Cau, head of equity strategy at Barclays, who believes that the good results published this month are “less worse than expected”. In the eyes of Samy Chaar, chief economist at Lombard Odier, these very good profits prove that “the fundamentals of the private sector have returned to these three years with a certain solidity”.

Back to normal”

According to Samy Chaar, the 2023 results constitute a return “to normal” after “three fairly abnormal years at the economic level”. However, the very good shape of these large market capitalizations does not dispel concerns, at a time when dark clouds are accumulating for the Paris stock market.

Indeed, the financial results of the CAC 40 depend little on the growth of the French economy, but more on the global economic health, particularly that of China and the United States. However, the first is swimming in troubled waters while the second does not rule out a return of Donald Trump to the White House… In addition, Emmanuel Cau, head of Barclays’ equity strategy. warns of the risk of a “backlash” represented by the expected drop in inflation, which has contributed to supporting the financial results of large French groups.