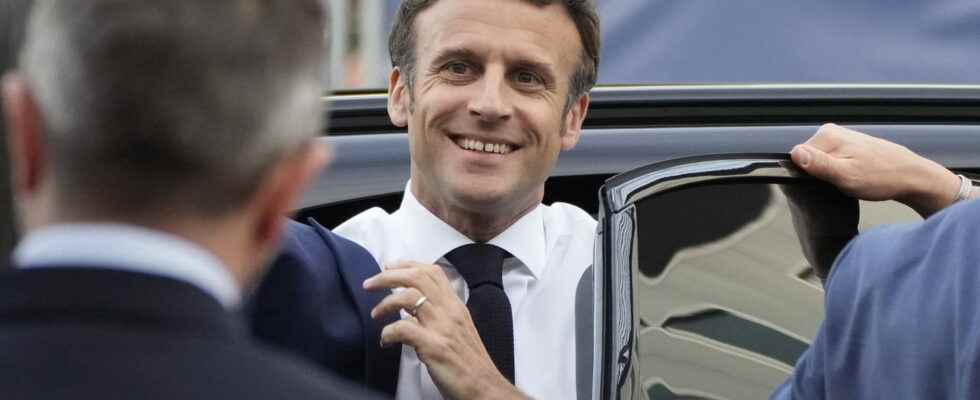

PRIME MACRON 2022. During the debate between two rounds against Marine Le Pen, Emmanuel Macron confirmed his wish to triple the exceptional purchasing power bonus to reach 6,000 euros.

[Mis à jour le 21 avril 2022 à 09h31] The “employee dividend“, the famous. Once again, Emmanuel Macron praised it during the debate between two rounds against Marine Le Pen, this Wednesday, April 20. The candidate president wishes to give back to the French the fruit of their investment in work during these last years of crisis. And this, without contributions for the employer and without taxes for the employee. “It will go from 1,000 euros to 6,000 euros“As he wanted to recall. Indeed, the Macron bonus could well triple in the event of the second term of the candidate LREM. From 1,000 to 3,000 euros for any company and from 2,000 to 6,000 euros for companies that have signed an agreementprofit-sharing.

All companies can pay it, and on a completely voluntary basis. Attention, only employees whose salary does not exceed three times the amount of the Smic can claim it. This “PEPA” bonus aims to strengthen the purchasing power of the most modest French households after two years of the covid crisis, and the recent rise in inflation (+4.5%) following the start of the war in Ukraine. Last year, no less than 4 million employees were able to benefit from it, and the average amount of this PEPA bonus was 506 euros.

Since 2019, employees have been able to receive an exceptional bonus, exempt from taxes and social security contributions called the “Macron bonus”. This exceptional purchasing power bonus (is paid by any employer who wishes it to employees, under certain conditions. In particular if the employee in question does not exceed a certain income limit. This tax and social security exemption scheme aims to encourage employers to pay bonuses to their employees in order to enhance their purchasing power. It is not a state bonus, but a company bonus which remains optional and voluntary.

To be exempt from employee contributions, the Macron bonus cannot exceed the amount of €1,000. Companies that have a profit-sharing agreement can pay the Macron bonus up to €2,000. This amount, doubled, is also valid for companies with fewer than 50 employees, and second-line workers (if revaluation measures are taken). This bonus could now triple in the event of the re-election of the LREM candidate on April 24, going from 1,000 euros to 3,000 euros. And up to 6,000 euros without charges or taxes for companies benefiting from a profit-sharing agreement.

The amount of the Macron bonus exempt from contributions is capped at €1,000. However, this amount may double and reach €2,000 in the following cases:

- The company has signed a profit-sharing agreement

- The company has less than 50 employees

- Second-line workers (if upgrading measures are taken)

The exceptional purchasing power bonus is exempt from income tax and from any social security contributions or contributions. But then, who is eligible for the Macron bonus? Employees earning less than 3 times the Smic (over the 12 months preceding the payment). This Macron bonus does not replace any element of remuneration.

The Macron bonus is paid within a period provided for by law. In this case, between the June 1, 2021 and the March 31, 2022. Whether you are a civil servant, an employee, or an industrialist, you have the possibility of benefiting from it.

Already extended in 2021, the premium PEPA is renewed for the year 2022. Note that the employer is not obliged to pay the Macron bonus. If he wishes to pay it, he has the option of doing so atall of its employeesor only to employees whose remuneration is less than 3 times the Smic.

In 2022, the Macron bonus benefits both employees and apprentices, as well as temporary workers and public officials. The employer can completely modulate the amount of the payment of the PEPA bonus according to the beneficiary according to certain criteria such as the employee’s remuneration, the employee’s classification level, his working conditions during the Covid crisis, or still his working time over a year.