(Finance) – The Wall Street stock market continues to rise after the inflation data turned out to be better than analysts’ expectations and with investors betting that the 25 basis point rate hike, now taken for granted in July, will be the last of the cycle for the Federal Reserve. In the meantime, we are already looking at the beginning of the quarterly season, which will come alive on Friday with the big American banks.

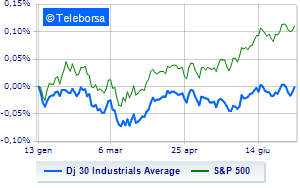

Among US indices, the Dow Jones an increase of 0.41%, consolidating the series of three consecutive increases, which began last Monday; along the same lines, earnings day for theS&P-500, which continues the day at 4,476 points. Good performance of NASDAQ 100 (+1.17%); with the same direction, rising theS&P 100 (+0.96%).

Positive result in the S&P 500 basket for sectors materials (+1.48%), utilities (+1.35%) and telecommunications (+1.29%).

At the top of the rankings American giants components of the Dow Jones, Home Depot (+2.24%), Goldman Sachs (+2.04%), Microsoft (+1.51%) and Salesforce (+1.43%).

The worst performances, however, are recorded on cisco systemswhich gets -2.58%.

The negative performance of United Healthwhich drops by 1.80%.

Undertone Travelers Company showing a filing of 0.99%.

Disappointing IBMwhich lies just below the levels of the eve.

Between protagonists of the Nasdaq 100, PDD Holdings (+6.19%), JD.com (+4.54%), Enphase Energy (+4.23%) and Modern (+3.29%).

The strongest declines, however, occur on polishwhich continues the session with -11.82%.

Bad performance for Palo Alto Networkswhich records a drop of 6.62%.

Black session for Zscalerwhich leaves a loss of 6.11% on the table.

CrowdStrike Holdings drops by 3.22%.