(Finance) – Positive session for the European stock markets, which closed close to the session highs after the difficulties of the afternoon linked to the release of an important macroeconomic data in the USA and the performance of Wall Street. The American market has in fact improved after a negative opening, due to a still strong labor market which could push the Fed to another rate increase. Notably, nonfarm payrolls increased by 336,000 in the United States last month, well above the consensus 170,000 jobs.

On the European front, the German manufacturing orders increased more than expected in August, while in the same month there was a decline in retail sales in Italy.

Regarding monetary policy, Isabel Schnabel (member of the Governing Council of the ECB) believes that it may be necessary to raise interest rates again if wages, profits or new supply problems cause inflation to rise. Klaas Knot (Bank of the Netherlands) believes that the ECB has a credible chance of returning inflation to the 2% target in 2025 after raising interest rates to the current level.

Slight increase forEuro / US Dollar, which shows an increase of 0.44%. Slightly rising seat for thegold, which advances to 1,832.7 dollars an ounce. Session on equality for the petrolium (Light Sweet Crude Oil), which stands at 82.2 dollars per barrel.

It advances a little spreadwhich rises to +201 basis points, highlighting an increase of 3 basis points, with the yield of the 10-year BTP equal to 4.91%.

Among the markets of the Old Continent well bought Frankfurtwhich marks a strong increase of 1.06%, small steps forward for Londonwhich marks a marginal increase of 0.58%, and Paris advances by 0.88%.

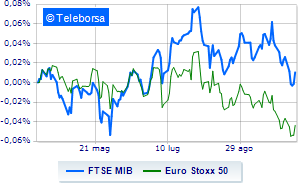

TO Business SquareThe FTSE MIB closes the day with an increase of 1.17%, to 27,813 points; along the same lines, the FTSE Italia All-Share continues the day up 1.12%. Salt the FTSE Italia Mid Cap (+0.78%); on the same trend, moderately rising FTSE Italia Star (+0.45%).

Between best performers of Milan, highlighted BPM desk (+3.46%), BPER (+3.00%), MPS Bank (+2.88%) e Unicredit (+2.86%).

The strongest sales, however, occur at Telecom Italiawhich closes trading at -5.89% (after the downgrade of Deutsche Bank to “sell” and the uncertainties on the network following the meeting between MEF and Vivendi). He hesitates Campari, which lost 1.43%. Basically weak Prysmian, which recorded a decline of 1.16%. It moves below parity Leonardohighlighting a decrease of 1.07%.

Among the protagonists of the FTSE MidCap, Maire Tecnimont (+14.23%, which continues yesterday’s rally after a maxi contract worth 8.7 billion dollars in Abu Dhabi), Intercos (+2.64%), Buzzi Unicem (+2.21%) e Believe me (+1.99%).

The strongest sales, however, occur at Alerion Clean Power, which ends trading at -4.23%. Goes down Antares Vision, with a decline of 4.13%. Negative session for Caltagirone SpA, which shows a loss of 1.81%. Under pressure MortgagesOnlinewhich suffered a decline of 1.60%.