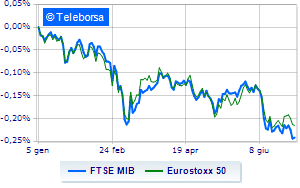

(Finance) – Positive balance for the financial markets of the Old Continent. Widespread purchases also affect the FTSE MIBwhich moves on the same bullish wave as the others Euroland lists, today orphans of Wall Street which will remain closed to celebrate Independence Day. Investors are still paying attention to central banks: in fact, the minutes of the Fed and the ECB arrive this week.

On the corporate front, focus on banking stocks after the Financial Times news that the European Central Bank is looking for ways to prevent lenders from making excessive extra profits with rising interest rates.

On the currency market, theEuro / US dollar shows a timid gain, with a progress of 0.30%. Slight drop ingold, which drops to $ 1,806 an ounce. Light Sweet Crude Oil rose slightly, rising to 108.8 dollars per barrel.

Uphill it spreadwhich reaches +190 basis points, with an increase of 6 basis points, with the yield of the ten-year BTP equal to 3.21%.

Among the markets of the Old Continent small step forward for Frankfurtshowing a progress of 0.37%, money on London, which recorded an increase of 1.14%; definitely positive balance for Paris, which boasts a progress of 1.06%. Slight increase for the Milanese stock exchange, with the FTSE MIB which rises by 0.52% to 21,465 points; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 23,484 points.

Among the best Blue Chips of Piazza Affari, effervescent DiaSorinwith an increase of 3.60%.

Glowing Tenariswhich boasts an incisive increase of 3.16%.

In the foreground Amplifonwhich shows a sharp increase of 3.03%.

Take off ENIwith an important increase of 2.78%.

The strongest falls, on the other hand, occur on Saipemwhich continues the session with -8.57%.

Sales on Intesa Sanpaolowhich recorded a decline of 1.99%.

Negative sitting for Banco BPMwhich shows a loss of 1.89%.

Under pressure Pirelliwhich shows a decrease of 1.12%.

Between best stocks in the FTSE MidCap, Mfe A (+ 5.55%), Alerion Clean Power (+ 3.59%), Brunello Cucinelli (+ 3.23%) e Autogrill (+ 2.39%).

The strongest sales, on the other hand, show up on Webuildwhich continues trading at -3.04%.

It slips Maire Tecnimontwith a clear disadvantage of 1.96%.

In red doValuewhich shows a marked decrease of 1.92%.

The negative performance of Fincantieriwhich falls by 1.70%.

Between the data relevant macroeconomics:

Monday 04/07/2022

08:00 Germany: Trade balance (2.7 billion euro expected; previous 3 billion euro)

11:00 am European Union: Production prices, annual (expected 36.7%; previous 37.2%)

11:00 am European Union: Production prices, monthly (1% expected; previous 1.2%)

Tuesday 05/07/2022

02:45 China: Caixin services PMI (preceding 41.4 points)

08:45 France: Industrial production, monthly (expected 0.3%; previous -0.1%).