(Tiper Stock Exchange) – The financial session of the European stock exchanges is moving upwards, after the gains achieved by the American and Asian markets where investors have chosen optimism by looking at the positive balance sheet accounts of the big US banks. However, caution is required in view of the key appointments next week with the decisions of the central banks.

On the currency market, theEuro / US Dollar, which continues the session on the previous day’s levels and stops at 1.123. L’Gold maintains substantially stable position at 1,978.3 dollars an ounce. Oil (Light Sweet Crude Oil) is substantially stable at 75.73 dollars per barrel.

Consolidate the levels of the eve lo spreadssettling at +166 basis points, with the yield on the ten-year BTP standing at 3.96%.

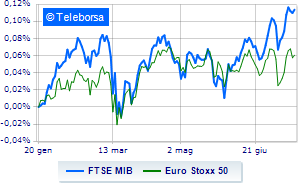

Among the markets of the Old Continent no cues Frankfurtwhich does not show significant changes in prices, money on Londonwhich recorded an increase of 1.25%, and a positive balance for Paris, which boasts an increase of 0.37%. The Milan Stock Exchange stops on parity, with the FTSEMIB which stands at 28,718 points; along the same lines, a day without infamy and without praise for the FTSE Italia All-Sharewhich remains at 30,743 points.

Among the best Blue Chips of Piazza Affari, a decidedly positive balance for utilities: snamwhich boasts an increase of 1.62%.

Good performance for A2A, which grows by 1.56%. Basically tonic Triad, which records a capital gain of 1.40%. Moderate income for ERGwhich increased by 1.32%.

The strongest declines, however, occur on Ivecowhich continues the session with -1.65%.

Decided decline for Inwitwhich marks a -1.5%.

Disappointing BPM deskwhich lies just below the levels of the eve.

Slack Monclerwhich shows a small decrease of 1.27%.

At the top among Italian stocks a mid-cap, Salcef Group (+3.79%), Sesa (+1.88%), IREN (+1.78%) and Saphilus (+1.52%).

The worst performances, however, are recorded on Replywhich gets -2.06%.

Modest descent for Ariston Holdingwhich drops a small -1.15%.

Thoughtful Tod’sa fractional decline of 0.99%.

He hesitates MFE Awith a modest decline of 0.85%.