(Tiper Stock Exchange) – Brilliant Piazza Affari, which is in line with the excellent performance of the main European stock exchanges on the day in which the ECB confirmed its “hawkish” position. The European central bank raised the cost of money by 50 basis points, announcing another similar hike in March. Also today, the Bank of England raised interest rates by another 50 basis points to 4%.

Meanwhile, there is a decidedly positive balance sheet on Wall Street, with theS&P-500 boasting a 1.36% gain, the day after the Federal Reserve also raised interest rates announcing further future tightening.

On the currency market, negativeEuro / US Dollar, down by 0.70%. Day to forget forgold, which trades at $1,916 an ounce, retracing by 1.76%. Slight drop in oil (Light Sweet Crude Oil), which drops to 76.3 dollars per barrel.

It goes down a lot spreadsreaching +173 basis points, with a sharp drop of 18 basis points, with the yield on the 10-year BTP standing at 3.75%.

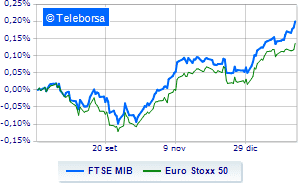

In the European stock market scenario incandescent Frankfurtwhich boasts a sharp increase of 2.16%, money up London, which recorded an increase of 0.76%; decidedly positive balance for Paris, which boasts an increase of 1.26%. Day of earnings for the Milan Stock Exchange, with the FTSEMIB, which shows a capital gain of 1.49%, continuing the positive series that began last Tuesday; along the same lines, the FTSE Italia All-Share ends the day up 1.44%.

The exchange value in today’s session in Piazza Affari it was equal to 3.24 billion euros, with an increase of no less than 481 million euros, equal to 17.45%, compared to the previous 2.76 billion; while the volumes traded went from 0.77 billion shares in the previous session to 1.23 billion today.

At the top of the ranking of the most important titles of Milan, we find Telecom Italy (+9.54%) after receiving the non-binding offer for NetC e Ferrari (+7.30%) after the accounts. He runs Nexi (+5.97%).

The strongest declines, however, occurred on CNH Industrialwhich closed the session at -7.50%.

In red Tenariswhich shows a marked decrease of 3.46%.

The negative performance of BPERwhich drops by 2.77%.

Saipem drops by 2.09%.

At the top of the mid-cap rankings from Milan, Sesa (+6.66%), Mfe A (+5.40%), Mortgages online (+5.16%) and Reply (+5.05%).

The worst performances, however, were recorded on Saraswhich closed at -9.67%.

It collapses Illimity Bankwith a drop of 4.42%.

Decided decline for De Nora Industrieswhich marks a -3.53%.

Under pressure believewith a sharp drop of 2.13%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Thursday 02/02/2023

08:00 Germany: Trade balance (expected 9.2 billion euros; previous 10.8 billion euros)

1.30pm USA: Challenger Layoffs (previously 43.65K units)

2.30pm USA: Unit labor cost, quarterly (expected 1.5%; previous 2%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 200K; Previously 186K)

2.30pm USA: Productivity, Quarterly (Expected 2.4%; Previous 1.4%).