TAX PAYMENT 2023. The tax payment deadline is coming. When do I have to pay the tax? And how to proceed?

After the declarative phase and the reimbursement period, it is now time to go to the cash register for taxpayers who have not paid enoughtaxes in 2023 to the tax authorities. Two months after the last declarations were sent by all French households, the General Directorate of Public Finances sent an email to those still liable for income tax. A few weeks ago, the opinion issued by the DGFiP had already allowed everyone to know their situation and whether they were going to receive or owe money to the State. This time it’s about the payment schedule. The administration warns nearly two months in advance that it will directly deduct a sum from the taxpayer’s current account so that he can pay his due.

When will I have to pay my taxes?

The administration has implemented a very simple rule regarding the payment of taxes, so as not to penalize taxpayers who are liable to the DGFiP. Two categories of people have been established: those who owe less than €300 and those who owe more than €300. In the first situation, the amount will be taken at once. In the second case, a schedule in four dates is automatically set up by the tax authorities. Here are the scheduled dates:

- Amount less than 300€ : direct debit on Monday, September 25, 2023

- Amount over €300 : direct debits on Monday September 25, 2023, Thursday October 26, 2023, Monday November 27, 2023 and Wednesday December 27, 2023

For the households most in difficulty, it is possible to stagger the payment of taxes further. To do this, simply make a request for a payment deadline, to be submitted no later than the last day of the month preceding the first direct debit, i.e. the Thursday, August 31, 2023. Steps need to be taken by clicking here.

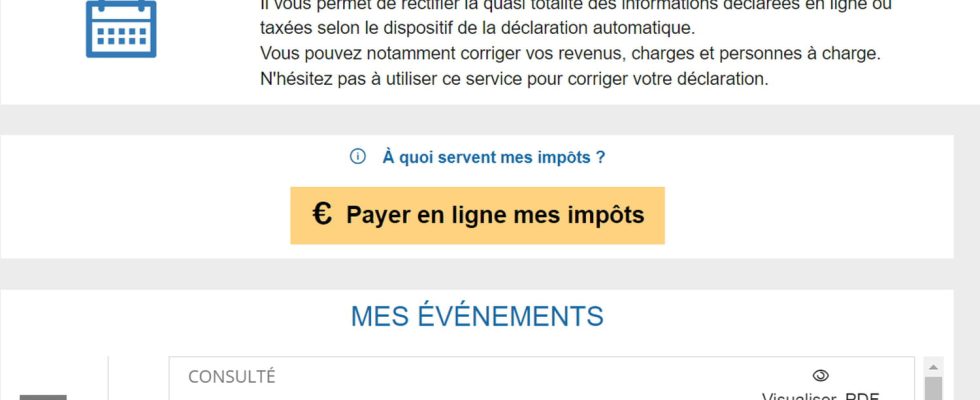

Direct debit, check, cash… How do I pay my taxes?

Now, with the introduction of the withholding tax, taxes are largely paid directly each month, directly from the pay slip. Generally, the remaining due is settled by a automatic tax debit from your bank account. But there are other solutions, in some cases.

If the amount to be paid by the taxpayer is more than 300€payment must be by direct debit. On the other hand, if it is less than 300€, a check can still be sent to the tax authorities. The balance can also be paid by credit card or cash with an approved service provider, whose list is here.