There is no age to start saving for retirement. This is what most advisors will say to you. Rightly so because, when it comes to investing, small streams make big rivers. Therefore, “putting aside even 50 euros per month at the start of your career is already a good start,” underlines Catherine Costa, director of wealth engineering at Milleis Banque Privée. However, this is not easy because, at this stage of one’s life, financial income is generally limited and projects are numerous. However, it is better to avoid letting time slip away and focus on your retirement as soon as possible.

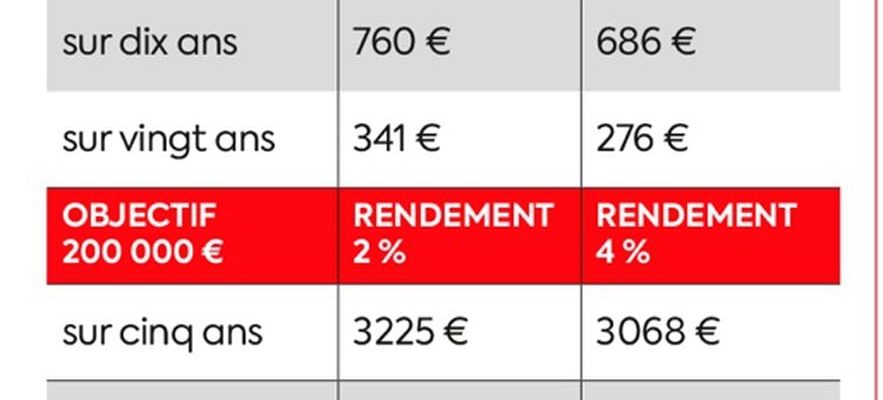

How much to save according to the desired objective?

© / DR

A first step is to measure your future needs. Depending on the progression of one’s career and one’s life goals, one must try to compare the expected level of one’s resources with the desired lifestyle. “Given the challenges and past and future reforms, there is a significant risk of seeing pensions deteriorate in the coming years,” anticipates Bertrand Merveille, deputy general manager of La Financière de l’Echiquier. The closer we get to the deadline, the more this estimate can be refined. This will make it possible to better assess the differential to be filled. Above all, don’t ignore the fourth age. “Your health can deteriorate very quickly,” points out Cédric Marc, founder of the wealth management consultancy firm Patrimonio Finance. “You need to provide financial and legal protection to deal with this risk.”

Where to start ? The answer differs depending on the horizon you have in front of you. We must therefore proceed in stages, while remembering that it is never too late to act!

Twenty years from retirement: getting into debt and taking risks

“When you have a long investment horizon, you need to boost your savings on the stock markets, recommends Catherine Costa. And if you are far from these subjects, you can delegate the management of your portfolio.” It is then your bank or your insurer who will take charge of its distribution and daily management, according to a risk profile that suits you. Setting up scheduled payments is recommended. “Investing regularly over the long term allows you to build up progressive capital and cushion fluctuations in the financial markets,” explains Cécile Gallizzi, wealth management advisor at DG Finances.

For this, several envelopes can be combined: the stock savings plan (PEA), life insurance and the retirement savings plan (PER). Dedicated to European equities, the PEA benefits from unbeatable taxation on exit since the gains are only subject to social security contributions. As for life insurance, it is essential. “Many business leaders worry about their retirement late, once their business has been sold,” relates Marie-Laure Decobert, wealth engineer at Swiss Life Banque Privée. Life insurance allows them to satisfy a need for additional income while optimizing their future transmission.”

Then, on to the PER. Created in 2019, the latter has several attractive characteristics: the payments are deductible from income (but the tax catches up with you on exit); you will be able to recover your savings in capital or in the form of an annuity, and there are several cases of early release to cope with hard times or to buy your main residence. “The PER is of great interest to people with high incomes who will be able to deduct their payments from taxable income,” notes Guillaume Gimbal, director of wealth management at Swiss Life Banque Privée.

For private sector employees, we must not forget the employee savings made available in many companies, via company savings plans and collective PERs. “These systems are also very advantageous for managers, indicates Cécile Gallizzi. For an investment of 100 euros, the company can pay up to 300 euros deductible from charges. By setting up participation and profit-sharing, the “The leverage effect is extraordinary. And you just need to have at least one employee.”

Finally, twenty years from maturity, you must take advantage of your debt capacity to bet on real estate. “The leverage effect of credit allows you to build assets without necessarily having capital in your current account,” recalls Cécile Gallizzi. If you are heavily taxed, you can opt for a bare ownership acquisition. “This makes it possible to acquire assets at a discounted price, without rental income, therefore without income tax, and which is not included in the real estate wealth tax base,” explains Elise Moras, director of studies. of the heritage engineering of Meeschaert Gestion Privée.

However, you must know how to maintain reason. “In household assets, the share of real estate is often too large, warns Bertrand Merveille. However, the stone market is not immune to the economic slowdown.” And if you need urgent money, it is not always easy to resell a house…

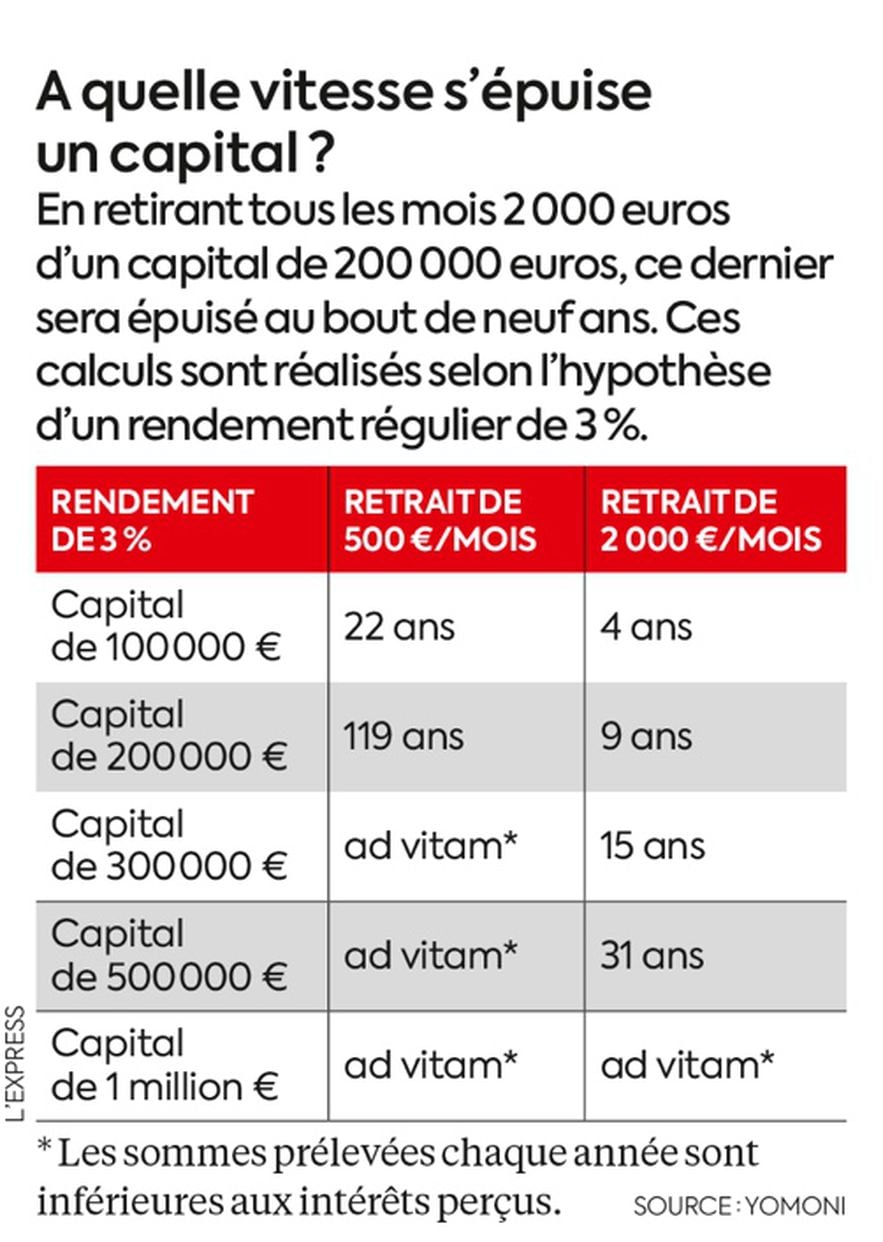

How quickly does capital deplete?

© / DR

Ten years from retirement: save fully

This is normally the period of life when professional income is at its highest. With the retirement horizon approaching, we must increase the envelopes previously subscribed to as much as possible.

If you haven’t stocked up on the stone side, you can still bet on real estate investment companies (SCPI). These can be acquired directly or on credit over relatively short periods. “This type of investment was more interesting before the rise in borrowing rates, but it remains interesting because we obtain rates lower than the yield of the SCPIs financed,” relates Cécile Gallizzi. In addition, borrowing interest is deductible from income perceived.” Another option: dismemberment, entirely feasible over a period of ten years.

Finally, there is still time to take risks. “The 50-year decade is ideal for investing in private equity [NDLR : prise de participation dans le capital de PME non cotées], believes Cédric Marc. Ten years before retirement, forcing yourself to save fully for four or five years will allow you to obtain significant additional income thanks to the expected capital gain.” To access them, these vehicles generally require 100,000 euros, but the Capital must be paid progressively: you must therefore be able to contribute a quarter of this sum each year. In addition, it is recommended to diversify your investment across 3 or 4 products. The total amount to be immobilized is therefore significant. If you do not have such sums, it is possible to play the private equity card in certain life insurance contracts, which give access to this type of fund for only a few thousand euros. : the earning potential will be less.

Five years from retirement: aim for performance and diversify

As the deadline approaches, the question arises of starting to reduce the amount of risk in your investments. “We must secure the part which will be essential to generate additional income in order to avoid having to lower our lifestyle”, indicates Elise Moras. Fortunately, the current landscape offers interesting supports. “The money market currently provides 4% yield and bond funds deliver 5 to 8% per year in the form of regular coupons,” describes Guillaume Gimbal.

But there is no point in completely desensitizing yourself. “You will not need to recover all of your capital upon retirement,” explains Bertrand Merveille. “You should ideally continue to capitalize on risky assets while planning to reduce them little by little.”

A tip: if you have sums to invest, it may be wise to pay them into a new life insurance contract to draw from within eight years. In fact, when you carry out redemptions, only the share of interest included in them is taxed. “A new contract will have accumulated less performance, so the gains will be low and the withdrawal will be less taxed,” relates Catherine Costa. A useful stratagem if the amount of early withdrawals exceeds the exemption ceilings (4,600 euros per year for a single person, 9,200 euros for a couple).

Finally, this may be the time to anticipate the exit from your PER and to ask yourself the question of a life annuity if you have little assets aside. “Transferring your survival risk to the insurer can be clever,” considers Cédric Marc. In fact, in this case, you give up your capital to the company in exchange for a lifetime income.

.