(Finance) – Strong decline for Oracle which trades at a loss of 11.19% on previous values, after the software company’s turnover disappointed expectations.

Oralche closed the second quarter of fiscal 2024 (ended last November 30), with net profits up from 1.74 billion dollars, equal to 63 cents per share, to 2.50 billion, and 89 cents. On an adjusted basis theEPS it stood at 1.34 dollars, against the 1.33 dollars estimated by analysts. THE revenues they rose from 12.28 to 12.94 billion dollars, however lower than the consensus of 13.05 billion.

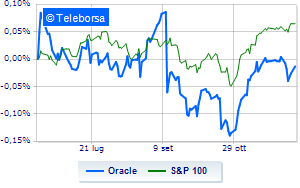

For the current quarter, Oracle expects revenues to rise by 6%-8% per year versus the +7.5% indicated by analysts.The technical scenario seen in one week of the stock compared to the index S&P 100highlights a slowdown in the trend of leading enterprise software provider compared toS&P 100and this makes the stock a potential selling target for investors.

The short trend of Oracle it is strengthening with a resistance area seen at 104.1 USD, while the most immediate support can be seen at 101.2. A continuation of the upward trend towards 107 is expected.