(Tiper Stock Exchange) – The session continues negative for the European stock exchangeswith the theme related to future moves by central banks which remains the major concern for the markets in the current context. Wall Street is also showing a downward trend.

Francois Villeroy de Galhaugovernor of the French central bank, said ECB interest rates will likely peak over the summer and a rate cut this year is out of the question. Isabel Schnabela member of the ECB’s executive board, said investors may be underestimating the persistence of inflation in the Eurozone.

L’Euro / US Dollar the session continued just below parity, with a drop of 0.34%. loses groundgold, trading at $1,823.9 an ounce, retracing by 0.76%. Day to forget for the petrolium (Light Sweet Crude Oil), which trades at 75.27 dollars per barrel, down 4.10%. On the levels of the eve it spreadswhich remains at +174 basis points, with the yield of 10-year BTP which stands at 4.18%.

Among the indices of Euroland thoughtful Frankfurtwith a fractional drop of 0.50%, falters Londondown a modest 0.24%, and a lackluster day for Pariswhich marks a decrease of 0.28%.

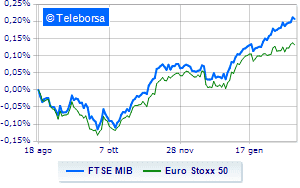

TO Milanmoves below parity the FTSEMIB, which drops to 27,739 points, with a percentage difference of 0.41%, breaking the positive chain of four consecutive increases, which began last Monday; along the same lines, slightly down the FTSE Italia All-Share, which continues the day below parity at 29,984 points. Slightly down the FTSE Italia Mid Cap (-0.22%); with similar direction, in fractional decline the FTSE Italy Star (-0.47%).

Among the best Blue Chips of Piazza Affari, incandescent BPER, which boasts an incisive increase of 4.56%. In the foreground Telecom Italy, which shows a sharp increase of 3.83%. Good insights on BPM desk, showing a large lead of 1.56%. Resistant Inwitwhich marks a small increase of 0.96%.

The strongest declines, however, occur on Tenaris, which continues the session with -4.38%. Bad sitting for ENI, which shows a loss of 2.72%. Under pressure amplifier, which shows a drop of 2.52%. Slide Pirelliwith a clear disadvantage of 1.70%.

Among the protagonists of the FTSE MidCap, MPS Bank (+7.04%), Banca Ifis (+3.56%), believe (+2.86%) and Danieli (+1.68%).

The strongest sales, on the other hand, show up Dry, which continues trading at -3.34%. In red MARR, which shows a marked decrease of 2.22%. The negative performance of De Nora Industrieswhich drops by 1.78%. Intercos drops by 1.66%.