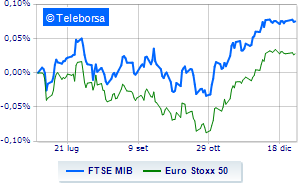

(Finance) – Widespread purchases on European stock marketswith the FTSE MIB which achieved the same positive performance as the Old Continent, in a last session of the year without great ideas. The markets are preparing to close 2023 with a significant increasewith the EURO STOXX 50 up 17% YTD and the STOXX Europe 600 up 12% YTD.

On the macroeconomic front, theSpanish inflation it fell in December 2023, also falling below analysts’ expectations (+3.1% on an annual basis vs. +3.2% in November and +3.4% estimated by the market).

No significant changes forEuro / US Dollar, which trades on the day before at 1.105. No significant changes forgold, which trades on the day before at 2,065.3 dollars an ounce. The oil market is substantially stable, continuing the session at the levels of the day before with oil (Light Sweet Crude Oil) trading at 71.99 dollars per barrel.

On equality, yes spreadwhich remains at +164 basis points, with the yield of the ten-year BTP which is positioned at 3.65%.

Among the main European stock exchanges modest performance for Frankfurtwhich shows a moderate increase of 0.27%, colorless Londonwhich does not record significant changes compared to the previous session, and is resistant Pariswhich marks a small increase of 0.28%.

The Milanese price list shows a timid gain, with the FTSE MIB which is achieving +0.33%; along the same lines, the FTSE Italia All-Share it makes a small leap forward of 0.32%, reaching 32,569 points. Just above parity the FTSE Italia Mid Cap (+0.28%); almost unchanged FTSE Italia Star (+0.09%).

Among the best Blue Chips of Piazza Affari, Fineco advances by 0.92%. It is moving modestly upwards Record yourself, highlighting an increase of 0.83%. Positive balance sheet for ERG, which boasts an increase of 0.77%. Substantially toned Monclerwhich recorded a capital gain of 0.76%.

The worst performances, however, are recorded on Telecom Italia, which gets -1.77%. He hesitates MPS Bankwith a modest decline of 0.91%.

At the top among Italian shares a mid-cap, Tinexta (+1.99%), Acea (+1.55%), Fincantieri (+1.26%) e GVS (+1.22%).

The steepest declines, however, occur at D’Amico, which continues the session with -1.57%. Slow day for LU-VE Group, which marks a decline of 1.31%. Small loss for Caltagirone SpA, which trades at -0.94%. He hesitates Pharmanutrawhich lost 0.88%.