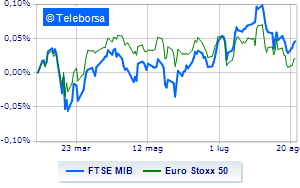

(Finance) – A day marked by caution for European stock markets, after some data that suggested a slowdown in economic activity in the Old Continent. On the other hand, the performance of Piazza Affari was excellent, which takes a large lead over the rest of Europe. On the American market there has been considerable progress for theS&P-500.

On the currency market, theEuro / US Dollar the session continued at the previous levels, reporting a variation of +0.09%. Positive session forgold, which is taking home a gain of 1.06%. Light Sweet Crude Oil lost 0.77% and continued to trade at $79.03 per barrel.

Unchanged it spreadswhich stands at +167 basis points, with the yield on the ten-year BTP standing at 4.17%.

Among the markets of the Old Continent flat Frankfurtwhich holds parity, composed Londonwhich grows by a modest +0.68%, and without any hints Paris, which does not show significant changes in prices. Seat up slightly for Piazza Affari, with the FTSEMIB, which advances to 28,232 points; along the same lines, the FTSE Italia All-Share makes a small leap forward of 0.21%, reaching 30,203 points.

Among the best Blue Chips of Piazza Affari, money up ERGwhich recorded an increase of 3.53%.

Very positive balance for Herawhich boasts an increase of 2.58%.

Good performance for snamwhich grows by 2.30%.

sustained Triadwith a decent gain of 2.15%.

The worst performances, however, are recorded on Unipolwhich gets -4.11%.

He suffers MPS Bankwhich shows a loss of 2.29%.

Prey of sellers Monclerwith a decrease of 1.62%.

Moderate contraction for Tenariswhich suffers a drop of 0.98%.

Among the protagonists of the FTSE MidCap, Alerion Clean Power (+3.73%), IREN (+2.87%), Caltagirone SpA (+2.05%) and Ascopiave (+1.88%).

The worst performances, however, are recorded on Carel Industrieswhich gets -2.90%.

They focus their sales on Technogymwhich suffers a drop of 2.70%.

Sales on UnipolSaiwhich records a drop of 2.55%.

Bad sitting for GV extensionwhich shows a loss of 2.38%.