With rising interest rates, solid returns in 2023, and a very promising start to 2024, the sky is clearing for savers. A flexible tool with preferential taxation, life insurance is once again becoming attractive and the safest of banking investments. However, in a context of inflation, diversification remains the wisest course. Identify your needs, identify the different products available, negotiate your contract, go through a management company, monitor costs, generate long-term performance: L’Express guides you.

Life insurance appears like a Swiss army knife allowing you to cover multiple needs or projects. This is not a reason to settle for the first contract that comes along, quite the contrary. Beyond the standard analysis criteria, it is better to gauge the offer according to your needs. Indeed, depending on your expectations, you will not opt for the same envelope. If you are a newbie and want to secure the capital of an inheritance, there is no point, or even imprudence, in embarking on a product that is too complex. If you want to build up a nest egg for your young child, it will be particularly damaging to open an envelope that is not very scalable because it will be kept for years. To avoid these misdirections, it is important to clearly identify your heritage goal before making any investment decision. Here are five of the most common goals and our selection to achieve them.

Objective 1 : Build a pot

Accumulating is the act of saving par excellence. Later, this capital will be used for a real estate purchase, to finance your children’s studies, to supplement your retirement, etc. To build this nest egg, saving regularly remains the best method to follow, which life insurance allows with the establishment of scheduled payments – monthly or quarterly -, often by transfer from your bank account. This option remains very flexible: you will have the freedom to stop/resume/modify their amount at any time depending on your possibilities. It is of course possible to supplement your contract with a higher amount on an occasional basis, through a bonus, a donation or other.

Please note, on the market, the minimum payment thresholds vary, from a few dozen to several hundred or thousands of euros. Hence the importance of selecting a device that matches your savings capacity. On the management side, it seems appropriate to mix your savings between the euro fund and equity or diversified funds, the purchase price of which will be smoothed over time thanks to your scheduled payments. A cocktail to make according to your investment horizon, a priori quite long. To do this, choose simple envelopes with low costs.

Objective 2: Secure capital

For risk-free addicts, there is only one direction: the euro fund. Useful reminder: any money placed in this financial support has a capital guarantee, net of any costs taken by the insurer on the payments. And, a decisive advantage, the amount invested is not capped (except contractual limits, which are quite rare), allowing considerable sums to be deposited, for example following a donation, the sale of a business or ‘properties. Unsurprisingly, we must turn to contracts whose euro fund displays a high return – at least 2.50% net for 2023 – and especially inclined to remain so given the insurer’s policy and reserves which he has. For this, it is interesting to study the rates paid in past years as well as the company’s speech.

Distrust also about the conditions of access to funds in euros: although this is increasingly rare, certain players require, for large payments, to invest a part (30% for example) in units of account. Be meticulous to, in this way, do better than inflation, preventing your capital from losing its real value (and therefore its purchasing power). Please note: by investing a large sum, you will be able to put pressure on to cancel any fees taken on the payments.

Objective 3: Earn more!

Getting 3% return on the euro fund is not enough for you? You then need to diversify your savings to… earn more. This is theoretically possible by almost all life insurance companies, by integrating into their financial offering financial supports (funds) in shares or bonds, or even real estate, all called units of account, and supposed to yield more over time. Your guiding principle: determine the level of risk that you are prepared to take and your degree of expertise in this area, to then choose a contract adapted to your saver profile.

Two categories of life insurance should catch your attention. On the one hand, those whose financial offer includes 10 to 30 funds, which will be enough to diversify your capital between the euro fund and a handful of well-selected funds. This is the easiest approach to access if you don’t want to spend too much time or if you have limited knowledge. Even simpler, use managed management solutions, a paid service (with some exceptions). In this case, a professional selects the units of account and monitors them over time. Don’t trust with your eyes closed! Its effectiveness must be verified in light of past performance. For more informed savers, head for life insurance with a hundred or more supports. You will then be able to invest in niche markets, with more complex strategies and develop a larger portfolio. They can be found on the Internet or with wealth advisors, whose expertise will then be crucial for making the right investment choices.

Objective 4: Give meaning to your savings

What is the relationship between the environment and capital management? Or between the social and solidarity economy and life insurance? None, most investors will answer. However, as a long-term savings envelope, life insurance fits well with the idea of targeted investments on these themes. There are more and more media integrating extra-financial criteria in their stock selection or focusing on ecological sectors such as renewable energies. Moreover, the law requires insurers to include at least one ISR (socially responsible investment) labeled fund, another Greenfin certified (green finance) and finally a Finansol (solidarity) labeled vehicle in each of its contracts. Some limit themselves to this, others go much further. If the commercial choice becomes thicker, beware of green marketing!

To sort things out, the right solution is to turn to brands that have included this quest for meaning in their policy for several years, like some mutual insurance companies (Macif, Maif, etc.). In practice, it is often proposed to use piloted management, including labeled funds or based on specific themes (for example, water or biodiversity).

Goal 5: Help my children

If the Livret A remains a useful and often preferred tool for building up a nest egg for your children, is it the optimal solution? Not certain, given that deposits are capped there with diversification of savings impossible. As a result, and despite a long investment horizon, performance will be limited. Quite the opposite of life insurance, which can be opened in the name of a child from their first days, via the signature of their legal representatives. However, it will be necessary to stick to good family management, without excessive risk, and in terms of the beneficiary clause, the “legal heirs” will necessarily be designated.

Interesting: for a donation, an additional pact may partially regulate the use of capital by the child upon reaching the age of majority, up to the age of 25. Useful if you fear that he will squander this money once he turns 18. Given the conservation horizon of the contract, the management of which will automatically revert to the child upon reaching the age of majority, it is necessary to resolutely turn to life insurance that has proven itself and is, in short, durable. Favor players capable of evolving their products over time without systematically creating new offers. Some companies offer specific envelopes for minors, which often amounts to marketing dressing that should not be focused on.

An article from the special “Placements” section of L’Express, published in the weekly on April 11.

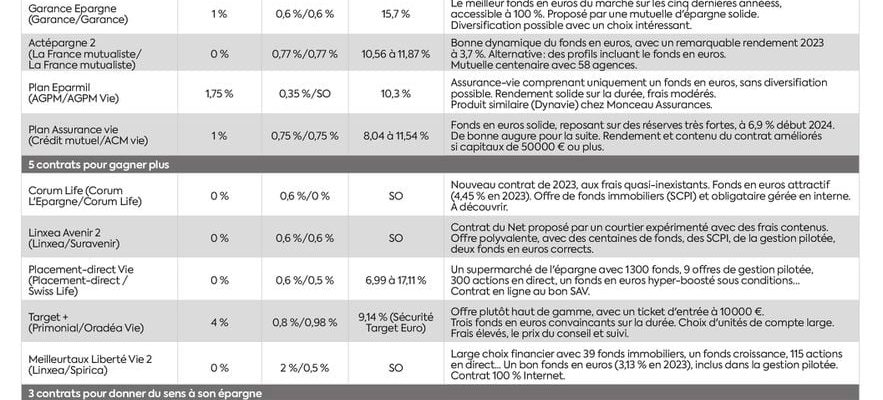

20 contracts adapted to your needs

© / The Express

.