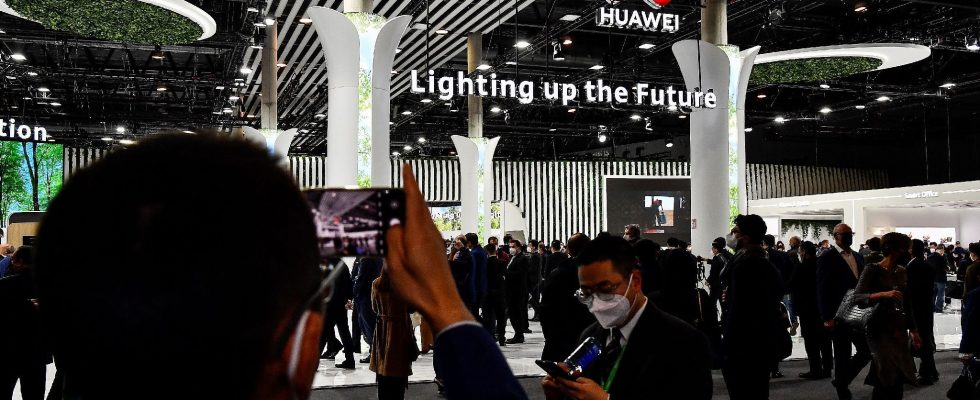

The American Secretary of Commerce, Gina Raimondo, tightened sanctions on electronic chips against China this week, after several snubs. Huawei recently unveiled a 5G smartphone with performance that seemed impossible to achieve so quickly. Another local tech giant, Baidu, has formalized the fourth version of its chatbot Ernie, touted as being as accurate as OpenAI’s GPT-4. The firm had legally acquired Nvidia A800 and H800 chips, specially designed to circumvent the restrictions in place for more than three years. As essential to the design of smartphones as consumer or military artificial intelligence (AI) systems, electronic chips have become the crux of the matter. Hindered in its technological development by these restrictions, China excels in its role of mouse, zigzagging between the claws of the American cat.

China aims for autonomy

How long will this little game between the two powers last? The effects of these measures are palpable on China: they are putting it several years behind. But the situation is gradually becoming more complex for the United States. Each new sanction brings China a little closer to autonomy in this area. This is precisely what the Huawei case shows: Chinese foundries have acquired know-how that they did not have before. These measures also strengthen Chinese aggressiveness. This is evidenced by the limits that Beijing put in place this summer on exports of strategic metals. Or the noise around the ban on Apple iPhones within the state apparatus, experienced as a warning, before a ban.

Above all, each new sanction penalizes the American chip industry more severely, in the largest domestic market in the world. La Sia – Semiconductor Industry Association –, the main organization in the sector, openly complained this week about new measures taken by its government intended to plug the small breaches opened by China. The capitalization of Nvidia, the leader in the graphics processor market, fell by around $80 billion after a drop of almost 5% in its price on Tuesday. The company will no longer be able to supply its famous A800 and H800. Intel and AMD will also be penalized. However, China still has the possibility of accessing first-rate computing power, particularly on the cloud, which has not yet been affected. Until the next screw tightening, when the mouse comes out of its hole again. But the price to pay is becoming more and more expensive for the United States.