(Finance) – The indexes of Piazza Affari and of the other main European lists were all negative at the end. Investors found themselves valuing growth alarms the OECD (reduced its global growth forecast for this year to 3% from 4.5% in the last quarterly update) and the World Bank (reduced its growth forecast for this year to 2.9% , sounding an alarm on stagflation), and have remained cautious ahead of the meeting of the Governing Council of the ECB of tomorrow. Analysts expect eurozone central bankers to announce that net purchases of the APP program will end in early July, that the inflation conditions for the lift-off have been met, and that the rate hike will begin in July.

Reviews of analyst recommendations moved i securities of the banking sector. BPER had an excellent session after an upgrade and waiting for the new business plan to be unveiled on Friday. In decline Banco BPM (with Intesa Sanpaolo which reduced the rating to Add from Buy), but also Fineco, Banca Generali And Mediolanum Bankwhose target prices have been reduced by UBS.

Slight growth ofEuro / US dollar, which rises to an altitude of 1.074. Slight increase ingold, which rises to $ 1,859.3 an ounce. Positive session for oil (Light Sweet Crude Oil), which shows a gain of 1.52%.

Consolidate the levels of the eve it spreadsettling at +200 basis points, with the yield of the ten-year BTP standing at 3.35%.

Among the main European stock exchanges sales on Frankfurtwhich recorded a decline of 0.76%, flat Londonwhich holds par, and negative sitting for Pariswhich shows a loss of 0.80%.

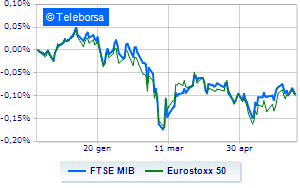

Caution prevails in closing in Piazza Affari, with the FTSE MIB which closes the session with a slight decrease of 0.53%; on the same line, a bad day for the FTSE Italia All-Sharewhich closes the session at 26,629 points, down by 0.74%.

The FTSE Italia Mid Cap (-0.25%); consolidates the levels of the eve on FTSE Italia Star (-0.08%).

The turnover in today’s session was 1.53 billion euros, up from 1.46 billion on the eve, while volumes stood at 0.44 billion shares, compared to the previous 0.37 billion. .

Between best performers of Milan, in evidence BPER (+ 2.92%), Mediobanca (+ 2.49%), Ferrari (+ 2.17%) e Stellantis (+ 0.86%).

The strongest declines, on the other hand, occurred on Nexiwhich closed the session at -2.79%.

Under pressure Banca Generaliwhich shows a decrease of 2.76%.

Goes down Monclerwith a fall of 2.60%.

Collapses Finecowith a decrease of 2.37%.

Among the protagonists of the FTSE MidCap, GVS (+ 6.09%), Mfe A (+ 5.47%), Seco (+ 3.24%) e Mfe B (+ 2.61%).

Stronger sales, on the other hand, fell on Anima Holdingwhich ended trading at -3.18%.

Sales hands on Danieliwhich suffers a decrease of 2.09%.

Bad performance for Safilowhich recorded a drop of 2.07%.

It slips MARRwith a clear disadvantage of 1.95%.

Between macroeconomic quantities most important:

Wednesday 08/06/2022

01:50 Japan: GDP, quarterly (expected -0.3%; previous 1%)

01:50 Japan: Current items (expected ¥ 511bn; previous ¥ 2,549.3bn)

08:00 Germany: Industrial production, monthly (1% expected; previous -3.7%)

08:45 France: Current items (previous – € 3.4 billion)

10:00 Italy: Retail sales, annual (previous 5.6%).