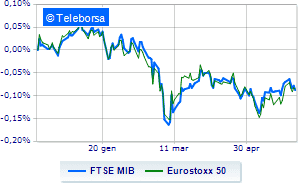

(Finance) – Piazza Affari is the worst European market in the session todaydistinguished from limited ideas and reduced exchanges, with London continuing to be closed for the Queen’s Jubilee holiday. The stocks of the Old Continent worsened further in the afternoon, with Wall Street opening lower due to better-than-expected US employment data: a strong labor market justifies a ‘aggressive action by the Fed.

To penalize the Milan Stock Exchange are the bankswhich show significant declines and also suffer fromincrease in the spread between ten-year BTPs and Bunds, which rose to 212 basis points in today’s session. The expectation is therefore growing for the ECB meeting next week, which could further move the Italian bond market.

Leonardo is positioned at the top of the FTSE MIB, after rumors according to which the German Rheinmetall has formalized a non-binding offer for 49% of Oto Melarawith the possibility in the future to become the majority shareholder of the historic manufacturer of artillery and armored vehicles. Tenaris reduces losses during the session, following a steep decline for theagreement with the SEC to close the investigation on alleged bribes to obtain orders from Petrobras (with a payment of over $ 78 million).

Caution prevails onEuro / US dollar, which continues the session with a slight decrease of 0.26%. L’Gold it is down (-0.78%) and stands at $ 1,853 an ounce. Positive session for oil (Light Sweet Crude Oil), which shows a gain of 2.00%. Salt it spreadsettling at +212 basis points, with an increase of 8 basis points, with the yield of the ten-year BTP equal to 3.40%.

Among the main European stock exchanges stop Frankfurtwhich marks almost nothing, and sluggish Pariswhich shows a small decrease of 0.23%. London it is closed for holidays.

Day “no” for the Italian stock exchangedown by 1.06% on FTSE MIBwhile, on the contrary, the FTSE Italia All-Share proceeds in small steps, advancing to 26,691 points. Negative changes for the FTSE Italia Mid Cap (-0.71%); on the same trend, down on FTSE Italia Star (-0.74%).

On the Milan Stock Exchange, the countervalue trading in today’s session amounted to 1.15 billion euros, down by 826.2 million euros, compared to 1.97 billion on the eve of the day; volumes stood at 0.36 billion shares, compared with the previous 0.56 billion.

At the top of the ranking of the most important titles of Milan, we find Leonardo (+ 1.96%), ENI (+ 1.32%) e Terna (+ 0.67%).

Stronger sales, on the other hand, fell on Finecowhich ended trading at -4.10%.

Collapses BPERwith a decrease of 3.40%.

Sales hands on Stellantiswhich suffers a decrease of 3.31%.

Bad performance for DiaSorinwhich recorded a decline of 2.94%.

Among the protagonists of the FTSE MidCap, Alerion Clean Power (+ 4.02%), OVS (+ 3.58%), Antares Vision (+ 3.06%) e Intercos (+ 2.90%).

The worst performances, however, were recorded on Juventuswhich closed at -4.16%.

Black session for Saint Lawrencewhich leaves a 3.49% loss on the table.

At a loss doValuewhich falls by 3.30%.

Heavy Datalogicwhich marks a drop of -3.18 percentage points.

Between macroeconomic quantities most important:

Friday 03/06/2022

08:00 Germany: Trade balance (1.6 billion euro expected; previous 1.9 billion euro)

08:45 France: Industrial production, monthly (expected 0.3%; previous -0.4%)

10:00 European Union: PMI services (expected 56.3 points; preceding 57.7 points)

10:00 European Union: Composite PMI (expected 54.9 points; preceding 55.8 points)

11:00 am European Union: Retail sales, annual (expected 5.4%; previous 1.6%).