Good news for China. The International Monetary Fund (IMF) revised its growth forecast for the Middle Kingdom in 2023 on Tuesday, November 7, now expecting 5.4% against a backdrop of a recovery in consumption and recent support measures for the economy. government.

The previous forecast was 5% for the world’s second-largest economy, while the IMF also raised its expectations for 2024, predicting an increase in Chinese GDP of 4.6%, compared to 4.2% previously.

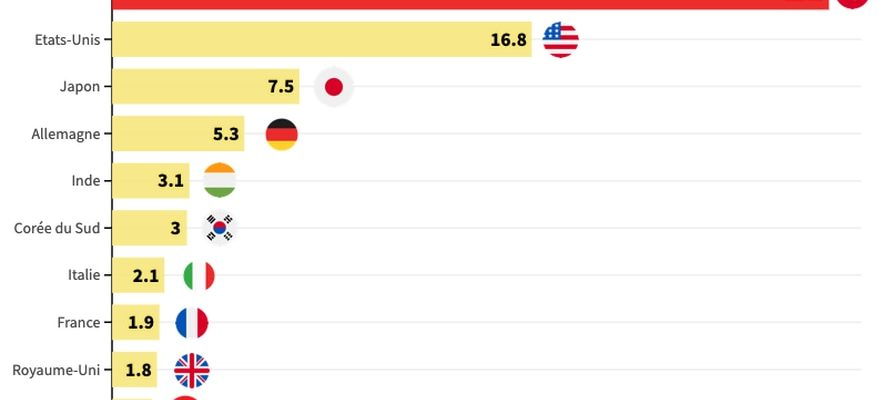

China remains the workshop of the world

© / The Express

A rebound in consumption

The improvement in forecasts reflects “a strong rebound in domestic demand, in particular consumption, after reopening” post-Covid, explained IMF number two, Gita Gopinath, at a press conference in Beijing.

It is also explained by “stronger growth than expected in the third quarter and the new support measures recently announced,” she added.

In the third quarter, China’s GDP grew by 4.9% year-on-year, a rate lower than that of the previous quarter (+6.3%) but higher than analysts’ expectations thanks to a recovery in consumption.

Retail sales, the main indicator of household consumption, accelerated sharply in September (+5.5% year-on-year), according to the National Bureau of Statistics (NBS). The start of a public holiday week at the end of September on the occasion of the national holiday (October 1) notably allowed tourism to rebound.

The country penalized by 3 years of closure

China is targeting “around 5%” growth this year, after 3% in 2022, which was then one of its lowest growth rates in four decades. The country has been penalized by almost three years of closure to the world, due to significant health restrictions linked to the Covid epidemic.

But he now wants to revive his economy. At the end of October, Beijing announced the issuance of sovereign bonds worth 1,000 billion yuan (130 billion euros) to stimulate infrastructure spending.

The government has also rolled out targeted stimulus measures for various sectors, particularly the struggling real estate market. On Tuesday, however, Gita Gopinath warned that the IMF expected “the real estate sector to remain weak and external demand to moderate.”

The Chinese authorities must in fact face turbulence in the real estate sector, which has long represented a quarter of the country’s gross domestic product, supports thousands of businesses and constitutes a major source of jobs.