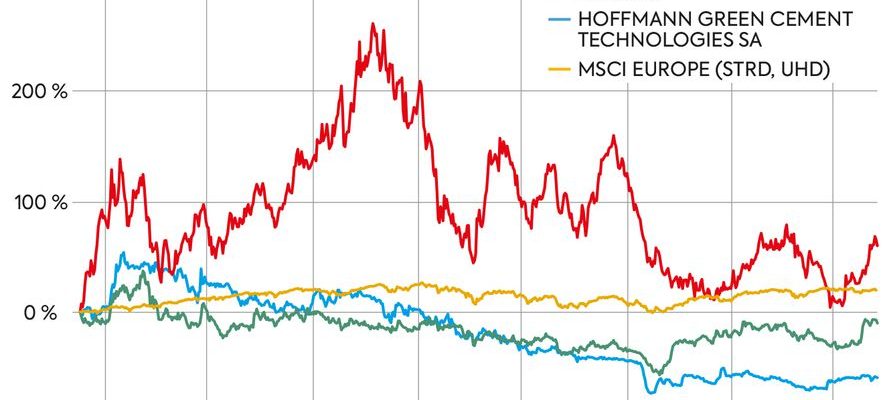

These three companies are recent, generally have mountains to move, seem both fragile and deserving. This is the case of Hoffmann Green Cement in cement, Carbios in bioplastics and Aker Carbon Capture in carbon sequestration. It goes without saying that by betting on disruptive technologies, they present investors with a riskier profile than the average. Risk-taking that is reflected in the volatility of their stock market prices.

Born in Vendée nine years ago, Hoffmann Green Cement (HGC) hopes to become a troublemaker in the oligopolistic universe of cement, one of the most CO2-emitting industries in the world. Logical, since the manufacture involves the exploitation of crushed clinker, a product of limestone heated to a very high temperature for eighteen hours, which consumes considerable energy. As for HGC, it proposes to… dispense with clinker, thanks to a cold activation process. Claimed result: a division by 4 to 6 of CO2 emissions and a process that consumes 10 to 15 times less energy. On paper, the offer is therefore particularly attractive.

The HGC solution has begun to appeal to leading construction groups. The contracts signed should make it possible to sell approximately 24,000 tonnes of cement in 2023, approximately double the level of 2022. But this remains a drop in the bucket and turnover remains very modest (approximately 5 million euros expected This year). However, the investments made or in the process of being made should make it possible to have an annual production capacity of 550,000 tonnes from 2026, a much more respectable level. On this horizon, the Vendée group expects a market share of 3% in France and a positive current operating result from 2025.

HGC has been listed on the stock exchange since 2019, with highs and – above all – lows. It is not easy to make a place for yourself in a sector that is not very inclined to see the lines move. But the company has undeniable assets: a solid shareholder base committed to operational management, recognized products, rapidly expanding production capacities and a favorable context given the environmental challenges.

© / Art Press

L’Oréal, Michelin and L’Occitane in the capital

Carbios, another French medium-sized company, has developed enzyme-based technologies for the recovery of plastic and textile waste and the production of biopolymers. His work attracted the venture capital subsidiaries of L’Oréal, Michelin or L’Occitane, which entered the capital. The so-called “green” chemistry start-up has just found a potential partner to build a first French plant for the biorecycling of PET plastic, the most common. Carbios is still at an early stage of its development, but several key milestones have already been reached. It is therefore a real bet on the plastic recycling ecosystem.

Head north to finish, with Aker Carbon Capture, the first player listed on the stock exchange entirely dedicated to capturing CO2 from industrial and oil extraction sites, the storage and reuse of which constitute solutions envisaged to combat global warming. Aker CC has proven technology in the field. Beyond the pilot sites and demonstrators, the Norwegian group is in the process of installing its large-scale devices at several manufacturers. Be careful, however: like Carbios or Hoffmann, the company is at the start of its life and is not yet profitable.

An article from the special issue of L’Express “Investing in the ecological transition: 20 values to follow”, published on July 6.