(Finance) – Bad day for Piazza Affari and the other main European stock exchanges, with investors revising their expectations regarding the timing of a central bank monetary policy overhaul, in the wake of new statements from euro area central bankers. The president of the ECB Christine Lagarde He said market bets on aggressive rate cuts do not help the fight against inflation, Klaas Knot stated that market expectations of rate cuts risk being self-defeating, Gediminas Simkus highlighted that he is much less optimistic than the markets regarding rate cuts in March or April.

On the macroeconomic front, it was confirmed in Eurozone inflation reaccelerating in December 2023: consumer prices recorded a +2.9% on a trend basis, in line with the preliminary estimate and expectations, and above the 2.4% of the previous month.

Substantially stable theEuro / US Dollar, which continues the session at the levels of the day before and stops at 1.088. L’Gold maintains the position essentially stable at 2,027.4 dollars an ounce. The petrolium (Light Sweet Crude Oil) falling (-1.98%) to 70.97 dollars per barrel.

Unchanged spreadwhich is positioned at +161 basis points, with the yield of the ten-year BTP which stands at 3.85%.

In the European stock market scenario stands out the negative performance of Frankfurtwhich falls by 0.90%, black session for Londonwhich leaves a loss of 1.62% on the table, and Paris drops by 1.02%.

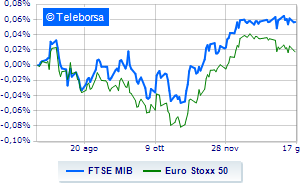

Trades down for the Milan Stock Exchangewhich suffered a decline of 0.99% on FTSE MIB; along the same lines, widespread sales on FTSE Italia All-Share, which continues the day at 32,124 points. Negative the FTSE Italia Mid Cap (-0.88%); along the same lines, negative variations for the FTSE Italia Star (-0.92%).

Between best performers of Milan, highlighted BPM desk (+1.20%), Mediobanca (+1.08%), Amplifon (+1.02%) e BPER (+1.01%).

The strongest sales, however, occur at Moncler, which continues trading at -2.93%. Decline decided for Hera, which marks -2.51%. Under pressure Brunello Cucinelli, with a sharp decline of 2.34%. He suffers Snamwhich highlights a loss of 2.30%.

Among the protagonists of the FTSE MidCap, Webuild (+1.45%), Banca Popolare di Sondrio (+1.01%), Philogen (+0.85%) e D’Amico (+0.75%).

The worst performances, however, are recorded on LU-VE Group, which gets -3.22%. Prey for sellers OVS, with a decrease of 3.01%. They focus on sales GVS, which suffers a decline of 2.68%. Sales up Salcef Groupwhich recorded a decline of 2.67%.