(Finance) – The Wall Street stock market continues to rise in a session characterized by the absence of large cues and volumes, given the approach of the Christmas holidays. The earnings are supported by the positive quarterly results of some big Americans, such as those of FedEx and Nike, which divert investors’ attention from fears related to the recession.

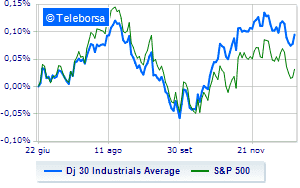

Among US indices, the Dow Jones trades sharply up (+1.53%) and reaches 33,353 points; on the same line, rising theS&P-500, which increases compared to the day before, reaching 3,877 points. Positive the NASDAQ 100 (+1.47%); along the same lines, in cash theS&P 100 (+1.49%).

At the top of the rankings American giants components of the Dow Jones, Nike (+13.52%), boeing (+4.13%), Apple (+2.15%) and Salesforce, (+2.13%).

The strongest sales, on the other hand, show up Walgreens Boots Alliance,which continues trading at -2.35%.

Between best performers of the Nasdaq 100, document sign, (+4.06%), Lululemon Athletica (+3.72%), Charter Communications, (+3.57%) and Idexx Laboratories, (+3.56%).

The strongest sales, on the other hand, show up Walgreens Boots Alliance,which continues trading at -2.35%.

The negative performance of Crowdstrike Holdings,which drops by 1.78%.

Slow day for Palo Alto Networks,which marks a decrease of 1.42%.

Small loss for Marriott International,which trades with -1.18%.

Between macroeconomic variables of greatest weight in the North American markets:

Wednesday 12/21/2022

2.30pm USA: Current Account, Quarterly (Exp. -$222B; Previous -238.7Bn)

4:00 pm USA: Consumer confidence, monthly (expected 101 points; previous 101.4 points)

4:00 pm USA: Sale of existing houses (expected 4.2 million units; previous 4.43 million units)

4:00 pm USA: Existing home sales, monthly (exp. -5.4%; previous -5.9%)

4.30pm USA: Oil inventories, weekly (exp -167K barrels; prev. 10.23M barrels).