(Finance) – A decidedly positive session for Braze,which trades up 18.27%.

The improvement in the guidance, for the full year, decided by the software company after a first quarter of growth contributes to assist the shares.

The period ended with an adjusted loss of 13 cents per share, lower than that of 19 cents in 2022. The figure is also better than analysts’ expectations, which remained at 18 cents. THE revenues they increased to 101.8 million from the previous 77.5 million and against the 99 million forecast by the consensus.

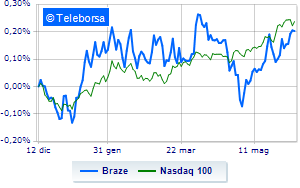

On a weekly basis, the stock’s trend is more solid than that of NASDAQ 100. At the moment, therefore, the appeal of investors is aimed more decisively at Braze, compared to the reference index.

Signs of strengthening for the short trend with the most immediate resistance seen at $42.83, with a current stage controlling support level estimated at 37.45. The balanced bullish strength of Braze, it is supported by the upward crossing of the 5-day moving average over the 34-day moving average. Due to the technical implications assumed, we should see a continuation of the bullish phase towards 48.22.