A new regulation comes into force and this is good news for customers.

Ask for money and receive it immediately in your pocket: only cash payment allows this, or almost. Some money transfer applications (Lydia, Paylib) also offer this possibility. If this use is still marginal, it will become more widespread in the coming months thanks to a new service that all banks will have to offer. Some already do it, but the regulations will now impose it on all establishments.

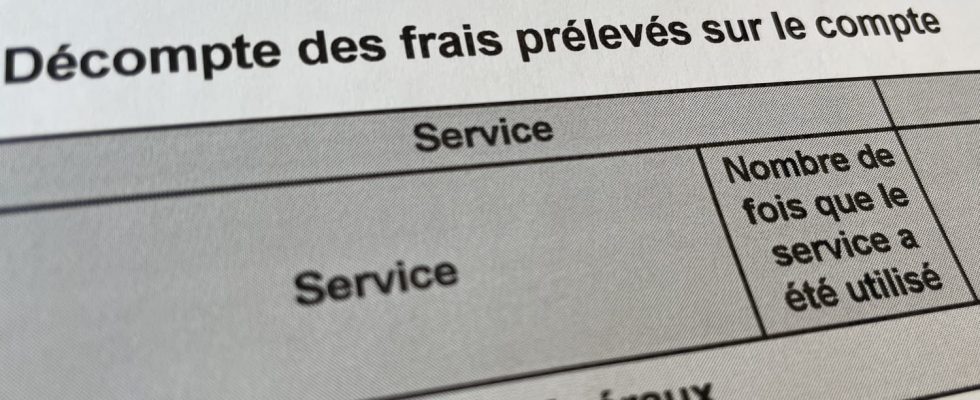

Currently, when you make a transfer from your bank account to another, 24/48 hours must be waited before the recipient receives the funds. However, some banks offer to make the transfer in a (very) short time: in 10 seconds, the money sent is already credited to the other account. An ultra-fast operation which is free in some establishments, but chargeable in others. From 1 euro to 5 euros. However, this will soon be illegal.

In fact, the European Union has decided to make the use of instant transfers between accounts free, even from different banks, and in the 27 countries of the Euro zone. So, money sent from France to Germany will arrive in 10 seconds, just like when the transfer goes from Spain to Estonia or from Greece to Ireland. And this, 24 hours a day, 7 days a week.

However, one nuance should be clarified: we are only talking here about the transfer of money, therefore not counting the validation time when adding a new beneficiary to your account. It may still take 48 hours before being accepted by your bank.

All establishments have a long period of time to comply with this new rule. It is only from Wednesday October 8, 2025, i.e. in a year and a half, that any instant transfer must be free.

Currently, few people use the instant transfer service, either through ignorance of the system or because it costs money. According to the latest data from the Banque de France, this only represents 6% of all transfers made (figures finalized in June 2023) with an average amount of 477 euros. But the share of this transfer method is increasing since it was only 3% in 2022.