(Finance) – With over 740,000 agricultural companies, 330,000 catering businesses, 70,000 food industries and 4 million workers, the Italian agri-food market is the third largest in the European Union and in 2023 it generated more than 65 billion euros, equal to 3.8% of the total Italian economy. It is therefore not surprising that many new entrepreneurial realities are emerging from the horizon which aim to renew such a strategic sector for our country: to date, there are around 340 startups active in the Agri-Foodtech sector, a market which in Italy has received an investment equal to 167 million euros in 2023, against 152 million the previous year (+9.8%).

In this scenario The first Italian Report on the state of Foodtech by Eatable Adventures is bornamong the main global accelerators in the Foodtech field, promoted by the Verona Agrifood Innovation Hub, the first development hub of the Italian Agrifoodtech ecosystem supported by the Cariverona Foundation, UniCredit, Eatable Adventures, the Municipality of Verona, Veronafiere, Confindustria Verona and the University of Verona.

In the analysis, startups are at the center of a survey that not only reveals the geographical and morphological distribution of startups, but also offers an updated picture of investments in the sector in 2023.

The identikit of Italian Foodtech startups: Northern Italy, agile teams and pink quotas

The North undisputedly dominates the panorama of startups in Italy: around a third (30.5%) is based in Lombardy, closely followed by Emilia-Romagna (11.1%) and then by Piedmont, Veneto and Lazio, from which approximately 10% of them come in a tie. Furthermore, 50% of the total startups were born between 2022 (25.3%) and 2023 (22.8%): a phenomenon that started in 2018 (7.6%) which, since 2021 it has recorded a real surge (19.1%)until reaching its peak in 2022. An increase, not only due to the growing interest in using to innovation to provide answers to the significant challenges of the agri-food supply chain and changes in consumption trends, but also to the creation of ecosystem support initiatives and new investment tools for emerging realities.

Looking at the composition of the startups, compact teams of 1 to 5 employees for approximately 69% of the sample, up to a maximum of 6-10 employees for 13%. Companies with an average age of 35.6 years, agile, still to be shaped and developed over time, not without the fundamental presence of female talents: as many as 32% of the startups were founded by one or more female founders, a very variable positive if we consider that the national average of female entrepreneurs stands at only around 10% of the total, while those with mixed teams do not exceed 16%3. This observation not only highlights the presence of women in key roles within the food technology sector, but also suggests that the industry has a particular appeal and actively engages female quotas.

The must haves of the sector: focus on production, food processing, brands and patents

There are four categories identified by Eatable Adventures in the analysis of the state of Foodtech in Italy: Agritech (technologies applied to agriculture), Food Production and Transformation, Retail&Distribution (applied robotics, retail analysis platforms, new sales channels etc.) and Restaurant Tech&Delivery (booking and management platforms; kitchen robots etc.). The startups are mainly concentrated in the Food Production and Processing segment (36%), followed by Agritech (22.3%), Restaurant Tech&Delivery (22%) and finally Retail&Distribution (19.6%).

Almost half of the startups (43%) active in Food Production and Processing focus on the creation of new products with innovative ingredients, while among those active in Agritech 33% have developed new cultivation systems or crop automation systems ( 31.5%). Another interesting fact is that 66% of the sample develops their own technologies internally, without making use of collaboration with third parties: only 12% cooperated with universities, 2% with technological centers and 13% with other external companies. This means that around 70% of startups show a remarkably high level of autonomous development, highlighting solid technological maturity.

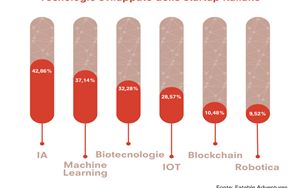

Looking at the most used technologies, artificial intelligence emerges as the predominant one, used by 42.86% of the startups interviewed; followed closely by machine learning, with a usage rate of 37.14% and biotechnology with a usage rate of 32.38%.

To protect the intellectual property of the innovations created, a fundamental element for guaranteeing competitiveness on the market, over half of the startups (54.3%) implement trademark registration in their business model and 40% own at least one patent, while the 19% rely on trade secrecy.

Investments in Italy: the state of the art

On the one hand, at a global level, investments in Foodtech recorded, in the second quarter of 2023, a decrease of approximately 61%4 compared to the previous year, mainly due to geopolitical conflicts and the economic crisis which have affected all sectors at 360°. On the other hand, however, the Italian market emerges among the most dynamic and growing with +9% compared to 2022: in 2023, in fact, Italian startups raised 167 million euros (43% in the seed phase; 32.3 % in the pre-seed phase), a figure that highlights the confidence of national and international investors in the growth potential of the segment.

Not only that: among the leading investments in Italy, training programs also stand out supported by companies such as CDP Venture Capital Sgr and Eatable Adventures itself with Foodseed, the first national accelerator in the Italian foodtech sector which, in 2023, selected and accelerated seven emerging Made in Italy companies, allocating an initial investment of 170 thousand to each euro – with the possibility of increasing up to a further 500 thousand euros for the best performing. A pioneering program that attracted the interest of primary sector partners who supported the initiative, including Amadori and Cattolica, Business Unit of Generali Italia.

As further resources that could facilitate their development, the startups interviewed report the attraction of international investors, the support from the Italian food industry, the presence at international events, the knowledge of best practices and the simplification of access to public aid .

“Italy is working increasingly hard to provide innovative responses to the pressures of climate change, the energy crisis and the supply of raw materials. The objective is to improve the global competitiveness of the Bel Paese and maintain its primacy in food and wine excellence in world-class,” he says José Luis Cabañero, CEO and founder of Eatable Adventures. “There are more and more initiatives involving food companies, startups, universities and technology centers, supported by important investors. Italy aims to preserve and strengthen its competitiveness and is ready to embrace innovation with determination to shape a future sustainable, efficient and dynamic food”.