(Tiper Stock Exchange) – After a sharply negative start, Wall Street improved during the sessionwith investors who find themselves evaluating important indications on the performance of the economy from quarterly reports of US financial giants, the first to report results in the quarterly season. In particular, he was concerned about the warning of JPMorganaccording to which there has been a “modest deterioration in the company’s macroeconomic outlook, which now reflects a slight recession in the central scenario“.

Bank of America reported above-expected earnings as rising interest rates dragged down net interest margin (NII). JPMorgan reported growing quarterly earnings on strong trading activity. Wells Fargo reported quarterly earnings down 50% and provisions increased. Citigroup reported lower quarterly earnings, while trading (especially in fixed income) bucked the trend.

BlackRockthe world’s largest fund manager, reported declining profits in the fourth quarter of 2022, while assets under management (INCREASE) stood at $8.59 trillion.

On the macroeconomic front, they moved in a contrasting way i import-export prices USA in December 2022. On the other hand, the index of the consumer confidence of the University of Michigan, which conducts a monthly survey of financial conditions and household attitudes towards the economy.

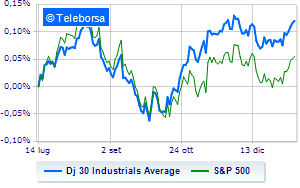

The New York Stock Exchange stops around paritywith the Dow Jones which stands at 34,198 points; on the same line, remains at the starting line theS&P-500 (New York), which stands at 3,979 points, close to previous levels. Without direction the NASDAQ 100 (-0.06%); with the same direction, almost unchangedS&P 100 (-0.05%).

At the top of the rankings American giants components of the Dow Jones, JP Morgan (+2.60%), United Health (+0.93%), Goldman Sachs (+0.78%) and Travelers Company (+0.58%).

The strongest declines, however, occur on Microsoftwhich continues the session with -0.98%.

Small loss for Walt Disneywhich trades with -0.91%.

He hesitates Verizon Communicationwhich drops 0.90%.

Basically weak Visawhich recorded a decrease of 0.90%.

Between best performers of the Nasdaq 100, Mercadolibre, (+5.81%), NetEase (+4.02%), Pinduoduo, Inc. Sponsored Adr (+3.87%) and light up, (+2.83%).

The strongest sales, on the other hand, show up Tesla Motorswhich continues trading at -2.57%.

Decided decline for Lucid Group,which marks a -2.47%.

Under pressure Adobe Systemswith a sharp drop of 1.53%.

It moves below parity Intuitionshowing a decrease of 1.44%.