(Finance) – Overwhelming rise for Xpo Logistics, which shows a burning rise of 13.93% on previous values after announcing the split into two separate listed companies. The transaction, as specified by the company, will have no tax impact for shareholders.

The logistics brokerage business will be separated from US trucking, while European operations and North American intermodal operations will be sold.

The separation is expected to be completed by the fourth quarter.

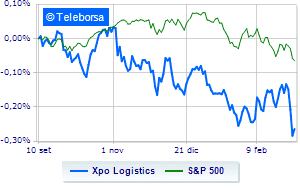

The trend of the stock analyzed on a weekly basis shows a trend similar to that of theS & P-500. This means that the stock is supported by elements from the market rather than news related to the company itself.

The overall technical environment highlights bearish implications that are strengthening for Xpo Logistics, with negative bias that would force levels towards the USD 69.45 estimated support area. Contrary to expectations, however, bullish solicitations could push prices up to 71.93 where there is an important resistance level. The dominance of the bears fuels negative expectations for the next session with a potential target set at 68.35.