China on Friday promised to help local governments overcome the ” financial difficulties “, the day after a major political meeting focused on relaunching growth, which has been slow since the Covid-19 pandemic. The explosion of local authority debt is one of the “ risks » identified by the power.

2 min

With our correspondent in Beijing, Clea Broadhurst

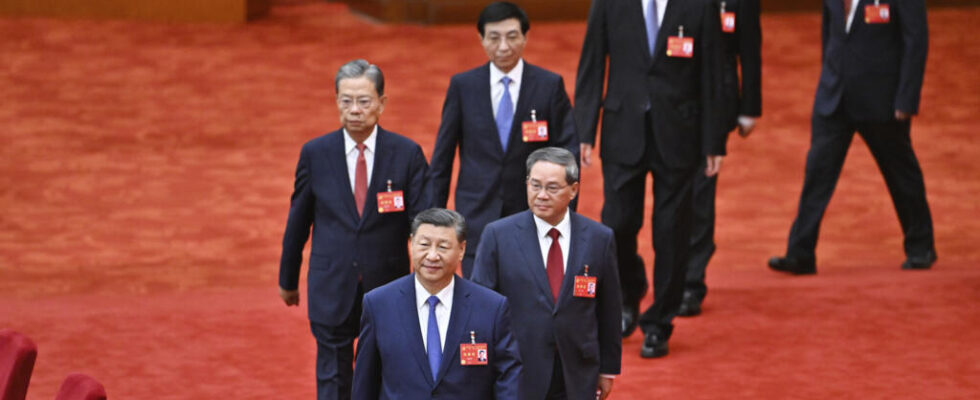

Many had hoped that the ruling Communist Party would announce sweeping changes to revive the economy at the end of the third plenary session of the 20th Central Committee of the Communist Party of China, held from July 15 to 18, 2024 in Beijing. Instead, the final communiqué contained few surprises.

The message is that the China must first complete a painful economic restructuring rather than implement a quick fix. The Asian giant is in the grip of an unprecedented crisis in its vast real estate sector, persistently weak consumption and high youth unemployment, while geopolitical tensions with Washington and the European Union threaten its foreign trade.

Authorities, however, reaffirmed their determination to meet this year’s economic targets, including annual growth of around 5 percent. The plenum said China would stick to its course of Xi Jinping which is to continue to develop the state economy alongside the private sector, promote new quality productivity, and maintain opening up and reform as the fundamental policy.

Real estate crisis penalizes growth and public finances

The meeting gave investors little reason to believe that leaders are preparing major stimulus measures to boost demand or stem the housing collapse that is at the root of China’s economic woes.

Read alsoChina: Economic challenges at the heart of the third plenum of the Chinese Communist Party

This situation is causing growing unease: some citizens are calling the post-pandemic period garbage time from history – “garbage time,” an expression that refers to the final moments of a sports match, when the losing team has no chance of coming back.

To stimulate the market, China reduced the minimum deposit for first-time buyers in May 2024 and proposed the purchase of unoccupied homes by local authorities. However, the country’s major cities again recorded a year-on-year drop in property prices in June, a sign of sluggish demand.

Of the 70 cities that make up the reference indicator, 68 were thus concerned (compared to 67 in May), according to official figures published on July 15, which reflect a deterioration in the situation. This is a record number.

Read alsoChina: “Hidden” provincial debt, a concern for public finances